In the dynamic world of cryptocurrencies, Bitcoin distinguishes itself not merely by adapting to market trends but also by influencing them. Central to its sustained growth and appeal is a concept that is critical yet often overlooked: the supply shock.

This phenomenon, characterized by limited supply juxtaposed with increasing demand, plays a significant role in driving Bitcoin’s value. But to understand the full impact of a supply shock, one must delve into Bitcoin’s limited supply and the mechanics of its halving cycles.

As we explore these aspects, we uncover a story of how scarcity can enhance value and how strategic design influences market behavior. This exploration is relevant not only to cryptocurrency enthusiasts and financial professionals but to anyone interested in the evolving landscape of digital currencies.

Join us as we embark on a pragmatic examination of the factors contributing to Bitcoin’s growth, focusing on the role of supply shock in shaping its market presence.

Supply Dynamics of Bitcoin

At the core of Bitcoin’s value proposition is its finite nature, famously capped at 21 million coins. This hard limit is a fundamental part of its design, distinguishing it from traditional fiat currencies that can be printed endlessly.

The scarcity of Bitcoin plays a crucial role in driving its demand. As more people become aware of and interested in Bitcoin, the fixed supply creates a natural scarcity that can lead to price appreciation. As of now, over 19.5 million Bitcoins have been mined, with the last coin expected to be mined around 2140.

This slow release of Bitcoin into circulation, paired with its capped limit, creates a unique supply dynamic. The gradual approach to reaching the cap ensures that the supply remains controlled, making Bitcoin a deflationary asset by design, further adding to its appeal as a store of value and a hedge against inflation.

The Bitcoin Halving Cycle and Its Impact

The Bitcoin halving cycle, occurring approximately every four years, is a pivotal event in the cryptocurrency’s ecosystem. During each halving, the reward for mining new blocks is cut in half, effectively reducing the rate at which new Bitcoins are introduced into circulation. Historically, these halving events have led to significant supply shocks.

For instance, the first halving in 2012 reduced the block reward from 50 to 25 BTC, and subsequent halvings in 2016 and 2020 continued this trend. These reductions in supply have often preceded major bull runs in Bitcoin’s price, as evidenced in the months following past halvings.

Looking ahead to the 2024 halving, there is widespread speculation about its potential impact. Given past trends, many anticipate a reduction in new supply to possibly trigger another significant price increase, as historical patterns suggest a correlation between halving events and substantial price movements in the following year.

Bitcoin’s Decreasing Supply on Exchanges

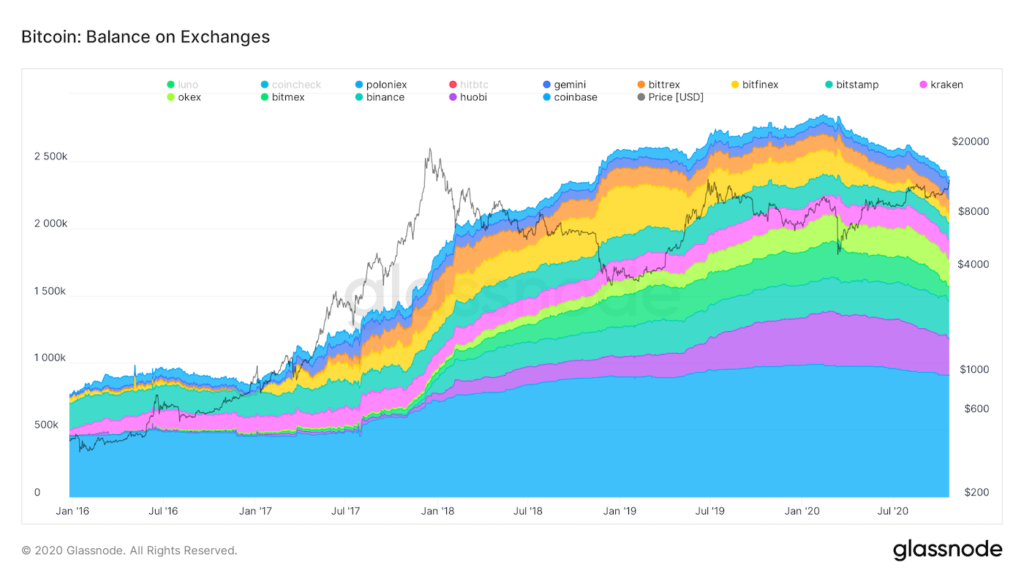

The trend of Bitcoin availability on major exchanges has undergone a notable shift since 2020. There has been a consistent decrease in the balance of Bitcoin held on exchanges, marking a significant change from the increase observed in previous years.

This decline suggests a growing trend of investors moving their Bitcoin holdings off exchanges and into private wallets, indicating a preference for long-term holding over immediate trading.

This shift contributes to a decrease in the liquid supply of Bitcoin available for trading on the open market, potentially leading to higher volatility and price increases due to supply constraints. The correlation between the decreasing supply of Bitcoin on exchanges and its price movements is significant.

As the available supply on exchanges diminishes, and assuming demand remains strong or increases, the basic economic principle of supply and demand suggests a bullish outlook for Bitcoin’s price, as has been observed in several instances post-2020.

The Illiquid Supply of Bitcoin and Market Dynamics

The concept of Bitcoin’s illiquid supply refers to the portion of Bitcoin that is not readily available for trading or selling on exchanges. This includes Bitcoins held in long-term storage, often in cold wallets, by investors who are not looking to sell in the near term.

In recent years, there has been a noticeable increase in Bitcoin’s illiquid supply. A growing number of investors are choosing to hold onto their Bitcoins, driven by a long-term belief in the cryptocurrency’s value.

This shift towards holding rather than trading is significantly impacting Bitcoin’s market value. As the illiquid supply increases, the available supply for trading decreases, creating a scarcity that can lead to price appreciation. This scarcity is particularly potent in the context of Bitcoin’s capped total supply, as it intensifies the asset’s inherent scarcity, making it more valuable over time.

The Perfect Storm for Bitcoin’s Price Surge

The upcoming Bitcoin halving in 2024 is set to create what many believe could be the perfect storm for a significant surge in Bitcoin’s price. Halvings reduce the rate at which new Bitcoins are created, effectively limiting the incoming supply. This event, combined with the increasing trend of Bitcoin being held as an illiquid asset, is poised to create a strong upward pressure on its price.

Additionally, the potential approval of Bitcoin ETFs could significantly influence Bitcoin’s ecosystem, bringing in a wave of institutional and retail investment. The combination of a decreasing supply due to the halving, a growing illiquid supply, and the potential influx of new investment from ETFs creates a unique scenario.

These factors, coupled with the continuous growth in demand for Bitcoin, make a strong case for substantial price increases in the next 12-18 months, as per the patterns observed in previous cycles.

Navigating the Future of Bitcoin’s Value Dynamics

The supply dynamics of Bitcoin, characterized by its finite nature, scheduled halvings, and increasing illiquid supply, play a crucial role in shaping its market value and investment appeal.

The impending halving event in 2024, alongside the potential introduction of Bitcoin ETFs and the ongoing trend of Bitcoin moving into long-term holdings, creates a scenario ripe for significant price appreciation.

As we look to the future, these factors collectively underscore Bitcoin’s potential as a lucrative investment asset. While the cryptocurrency market is known for its volatility, the underlying supply mechanisms of Bitcoin offer a compelling argument for its long-term growth and sustainability as a digital asset.

For investors and enthusiasts alike, understanding these dynamics is key to navigating the exciting yet complex world of Bitcoin.