The concept of real-world asset tokenization is revolutionizing the way we perceive and interact with financial assets. By converting tangible and intangible assets into digital tokens on a blockchain, tokenization is paving the way for a new era of asset management and investment.

This transformative process not only digitizes a wide array of assets—from real estate and art to commodities and more—but also democratizes access to these investments, traditionally reserved for a select few. As these tokenized assets become increasingly prevalent, they are recognized as a burgeoning asset class within the digital asset sphere, offering unprecedented levels of liquidity, transparency, and efficiency.

The essence of asset tokenization lies in its ability to break down barriers in the financial world, making the ownership of tokenized assets more accessible and divisible. Through blockchain technology, the process ensures that each token represents a specific stake in a real-world asset, thereby creating a direct link between the holder and the underlying asset.

This not only enhances the fungibility of various asset classes but also opens up new avenues for investors to explore and diversify their portfolios with tokenized financial assets. As we move towards a more tokenized economy, the distinction between traditional and digital assets blurs, heralding a future where the tokenization of real-world assets is not just an innovation but a fundamental shift in the asset management landscape.

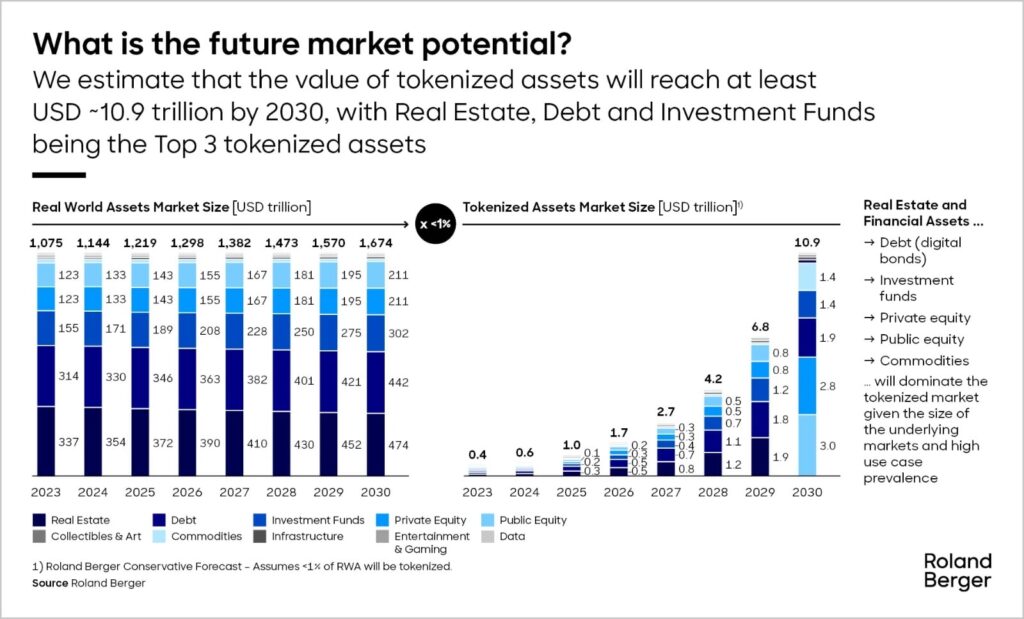

The $10 Trillion Market for RWAs by 2030

The projection that asset tokenization, particularly tokenized real-world assets (RWAs), will reach a staggering market value of $10 trillion by 2030 underscores the seismic shift expected in the financial landscape. This growth trajectory is fueled by the convergence of blockchain technology and the increasing demand for liquidity and accessibility in markets traditionally characterized by high barriers to entry.

Tokenizing physical assets into digital tokens on a blockchain not only promises to enhance liquidity but also to revolutionize how assets are bought, sold, and owned. Smart contracts play a pivotal role in this transformation, automating the execution of transactions and ensuring the terms of token ownership are adhered to, thereby reducing friction and increasing efficiency in the market for tokenized assets.

The promise of a more liquid and accessible market is attracting significant attention from investors and institutions alike, propelling the tokenization space towards its multi-trillion-dollar potential.

Institutional Interest and Technological Advancements

The burgeoning interest in asset tokenization has not gone unnoticed by institutional investors, as evidenced by the recent approval of Bitcoin spot ETFs and the forward-looking statements from financial giants like Larry Fink of BlackRock. Such ETFs are heralded as a critical stepping stone towards a broader acceptance and integration of tokenized assets within the mainstream financial ecosystem.

Fink’s assertion that the future of finance lies in the tokenization of every financial asset speaks volumes about the institutional optimism surrounding this technology. The embracement of blockchain technology by these financial behemoths signals a significant shift in how assets will be managed and traded, suggesting a future where digital tokens represent a substantial portion of institutional portfolios.

This institutional backing, coupled with technological advancements in smart contracts and blockchain, is setting the stage for a tokenized world where the lines between traditional financial assets and digital assets continue to blur.

Key Real-World Assets for Tokenization

Among the plethora of assets ripe for tokenization, real estate, art, and commodities like gold stand out as prime candidates for this innovative process. The appeal of tokenizing these assets lies in the ability to represent ownership through digital tokens on a blockchain, effectively democratizing access to investments that were previously out of reach for the average retail investor.

Real estate, in particular, benefits from tokenization by offering fractional ownership, thereby lowering the entry barrier and increasing liquidity in a market traditionally known for its illiquidity. Similarly, tokenizing art and commodities allows for a new form of investment, enabling investors to purchase shares in the value of a painting or a gold bar, all facilitated by blockchain technology.

This approach not only broadens the investor base but also adds a layer of transparency and efficiency to the transaction process, showcasing the transformative potential of tokenized real-world assets in diversifying and enhancing investment portfolios.

The Benefits of Real-World Asset Tokenization (DeFi)

The process of tokenizing real-world assets (RWA) onto a blockchain network heralds a transformative shift in asset management, particularly within the sphere of decentralized finance (DeFi). By leveraging blockchain technology to tokenize tangible assets like real estate, art, and commodities, the market is set to benefit from unparalleled levels of liquidity and accessibility.

Fractional ownership becomes a reality, breaking down financial barriers for retail investors and enabling participation in investment opportunities previously reserved for the affluent. Moreover, the inherent transparency of the ledger system underpinning blockchain networks ensures that every transaction is recorded, traceable, and immutable. This not only increases market efficiency but also instills a higher degree of trust among investors.

The decentralization aspect further democratizes asset ownership, removing the need for traditional intermediaries and thus reducing associated costs and complexities in asset management. Through crypto and blockchain, tokenizing assets promises to reshape the investment landscape, making it more inclusive, liquid, and transparent.

Leading Projects and Platforms

In the burgeoning field of asset tokenization, several projects and platforms are at the forefront, pioneering the integration of blockchain technology with real-world asset management. Homebase and Lofty have emerged as notable examples within the real estate sector, offering platforms where properties are tokenized, thereby facilitating fractional ownership and investment with significantly lower capital requirements.

Similarly, Maple Finance is making waves in the capital and debt markets by leveraging DeFi protocols to create a decentralized marketplace for corporate loans, effectively tokenizing debt instruments. Furthermore, the tokenization of government and treasury bonds is gaining traction, with initiatives aimed at digitizing these securities to enhance their liquidity and appeal to a broader investor base.

These efforts to tokenize assets like government bonds represent a significant step towards a more efficient and accessible financial ecosystem, showcasing the vast potential of blockchain technology in revolutionizing traditional finance sectors.

The Tokenized Future and Blockchain Infrastructure

The future of asset tokenization and its successful integration into the global financial system heavily relies on the robustness of blockchain infrastructure. As the demand for tokenized assets grows, the underlying technology must evolve to ensure scalability, security, and regulatory compliance.

Scalability is crucial to accommodate the increasing volume of transactions without compromising speed or increasing costs. Security remains paramount to protect against fraud and cyber threats, ensuring investor confidence in tokenized assets.

Moreover, regulatory compliance will play a critical role in the widespread adoption of tokenized assets, as legal frameworks adapt to the nuances of decentralized finance and crypto-based investments. The continued development and refinement of blockchain networks are essential to realizing the full potential of asset tokenization, making it a cornerstone of modern investment strategies.

As we look towards the future, the collaboration between technologists, regulators, and financial professionals will be key to unlocking the transformative power of tokenizing real-world assets, making them more accessible, liquid, and secure for investors worldwide.