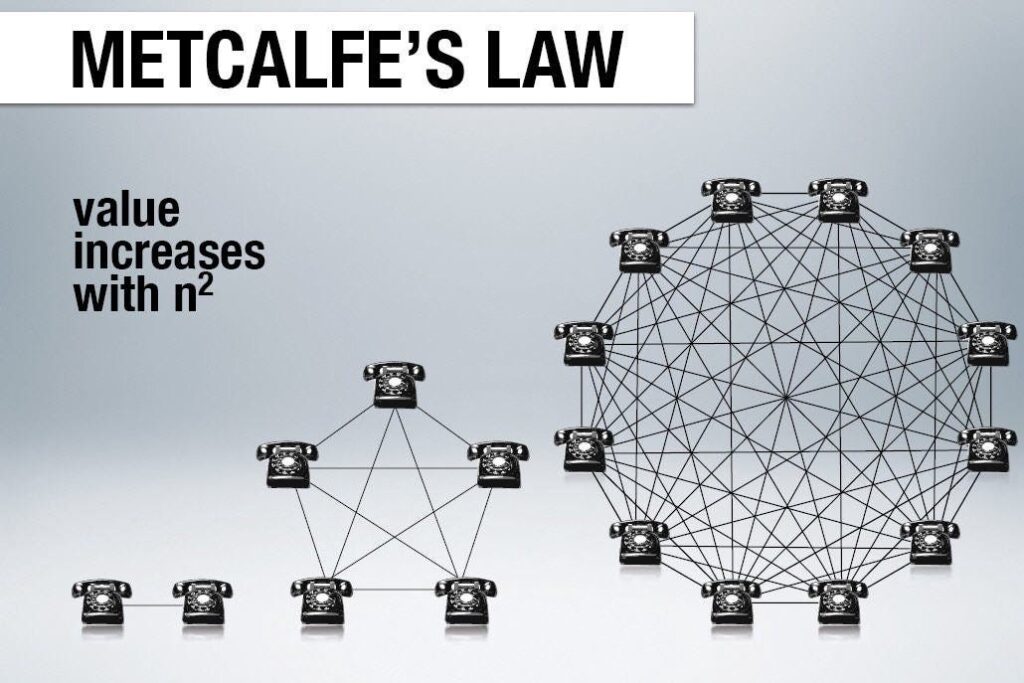

The concept of the network effect plays a pivotal role in determining the value and success of a digital currency. At its core, the network effect refers to the phenomenon where increased numbers of participants improve the value of a good or service — in this case, Bitcoin. Metcalfe’s law eloquently captures this idea, proposing that the value of a network is proportional to the square of the number of its users.

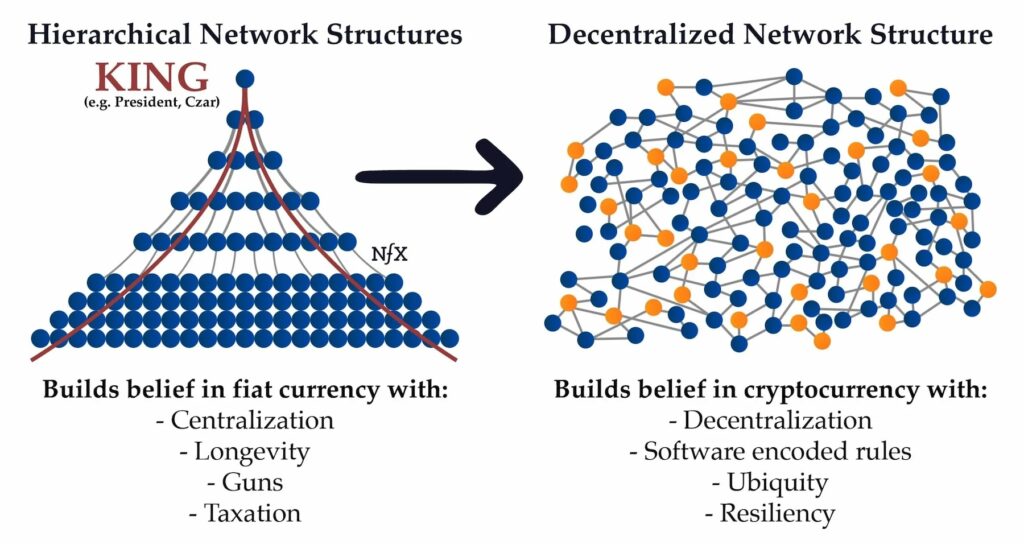

While traditional currencies and networks often rely on a top-down hierarchical structure, Bitcoin, alongside other cryptocurrencies like Ethereum, breaks this mold by leveraging a decentralized blockchain network. This foundational difference not only alters how value is exchanged and stored but also redefines Bitcoin’s role as a currency and a store of value within the global financial ecosystem.

In contrast to conventional network structures governed by central authorities or institutions, Bitcoin’s decentralized nature ensures that no single entity can exert control over the entire network. This decentralization is a key characteristic that differentiates Bitcoin from traditional currencies and even from other cryptocurrencies that might not be as decentralized.

By enabling direct peer-to-peer transactions without the need for an intermediary, Bitcoin empowers users to exchange value across the globe with unprecedented ease and security. Moreover, as more individuals and institutions use Bitcoin, whether for transactions, investment, or as a store of value, the intrinsic value of its network increases, further cementing its position in the crypto ecosystem. In this context, understanding Bitcoin’s network effect is very important in order to grasp its potential and impact as a revolutionary currency in the digital age.

Bitcoin’s Decentralization and Value Proposition

Bitcoin’s foundational principle is decentralization, a stark contrast to the centralized systems governing traditional finance and social networks. Unlike centralized structures, where a single point of control or failure exists, Bitcoin’s decentralized nature distributes power across its entire user base. This ensures no single entity, like a government or financial institution, can exert undue influence or control over the network.

Decentralization in Bitcoin is achieved through its distributed ledger technology, where each transaction is confirmed by consensus across a network of nodes, rather than a central authority. This architecture not only democratizes financial power but also enhances the security and resilience of the network.

The significance of decentralization extends beyond just technical aspects; it redefines the concept of value transfer in the digital age. In a decentralized network like Bitcoin’s, miners contribute to processing transactions and securing the network, receiving BTC as a reward for their efforts.

This process ensures that as the user base grows and more people use Bitcoin, the network inherently becomes more valuable. The increased number of users and nodes enhances liquidity and market depth on exchanges like Coinbase, making BTC a more accessible and versatile digital asset. This growth in user base and network activity fosters a virtuous cycle where enhanced utility and trust in Bitcoin further drive adoption and value.

Historical Context and Network Value

The phenomenon of network effects is not unique to Bitcoin or even digital assets; it has been observed across various technologies throughout history. One of the most cited examples is the telephone network. Initially, when only a few people owned telephones, the network’s value was limited.

However, as more individuals adopted the technology, the network’s value grew exponentially because each new user added exponentially more potential connections and interactions. This historical context provides a useful lens through which to view Bitcoin’s evolution.

Translating this to Bitcoin, the cryptocurrency has experienced similar network effects over its 15-year history. As more people and businesses have started to accept and use Bitcoin, its value and utility have increased significantly. Initially, Bitcoin was a novel technology with a small user base, but as awareness spread and adoption grew, the number of users and transactions on the network increased, enhancing its value.

This is in line with Metcalfe’s law, which posits that the value of a network is proportional to the square of the number of its users. For Bitcoin, this means that every new user or node that joins the network not only contributes to its security and decentralization but also to its overall value and appeal as a digital asset.

The Network Effects of Bitcoin in Detail

Over the past 15 years, Bitcoin’s network has seen substantial growth, not just in terms of its market capitalization but also in its fundamental network metrics. The number of active users, nodes, and daily transactions provides tangible evidence of this growth.

Each Bitcoin miner who joins the network increases its computational power, enhancing its security and the integrity of its transaction ledger. Simultaneously, every new user or business that accepts BTC contributes to its liquidity and utility, creating a more robust and valuable network.

This expansion of the Bitcoin network correlates directly with its value, adhering to Metcalfe’s law’s principles. As the network has expanded, so too has Bitcoin’s recognition as a legitimate financial asset and store of value. The increasing user base not only drives demand but also fosters a deeper understanding and integration of Bitcoin into the broader financial landscape. This, in turn, attracts more users, setting a positive feedback loop in motion that continues to enhance the intrinsic value of Bitcoin.

The detailed examination of Bitcoin’s network effects over time illustrates how its growth as a decentralized platform has not only persisted but accelerated, reinforcing its position as a leading digital asset and a transformative force in the financial world.

Comparative Analysis with Major Companies

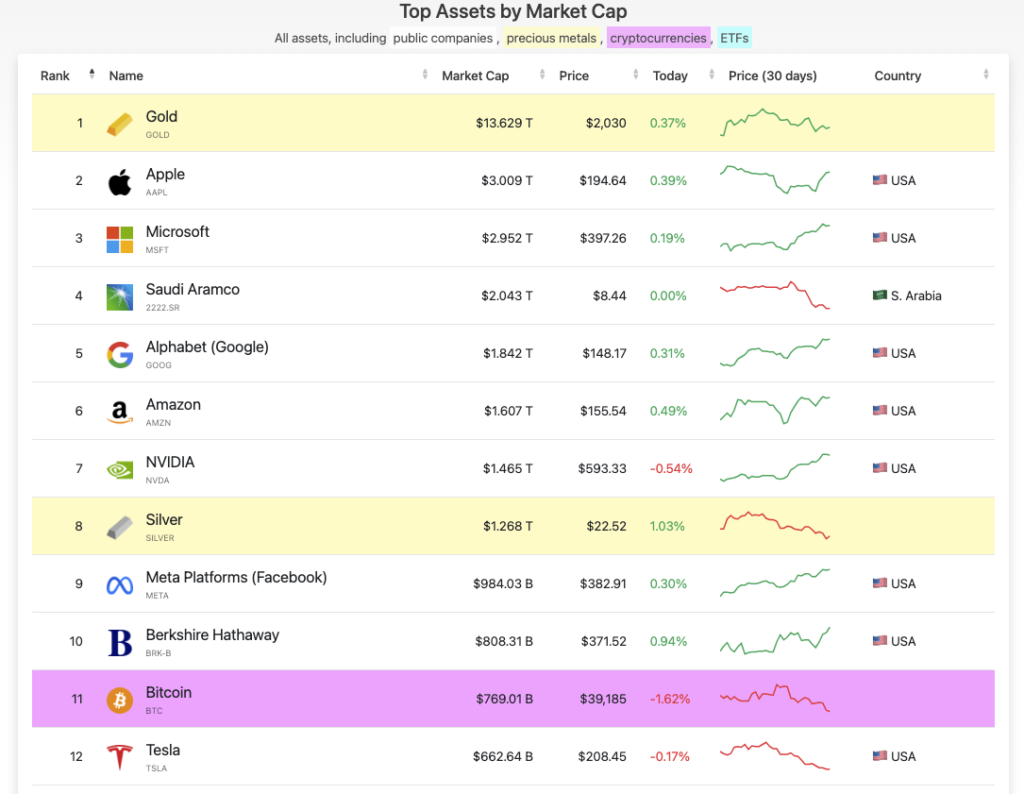

The network effects of Bitcoin can be compared with those experienced by significant technology companies like Apple, Google, and Amazon, which have capitalized on the exponential growth facilitated by increasing user bases. These tech giants have seen their market capitalization surge as more individuals and businesses integrated their services into daily routines, thus demonstrating the potent impact of network effects on valuation.

Similarly, Bitcoin’s network effect has been instrumental in its growth trajectory, as evidenced by its increasing price and market capitalization. As Bitcoin and Ethereum, two leading cryptocurrencies, continue to expand their networks, they exemplify a decentralized model contrasting with the centralized networks of major tech firms.

Yet, the underlying principle remains consistent: the value of a network increases with the square of its users, whether it’s users on a social platform, nodes on the Bitcoin network, or devices connected to the internet.

For Bitcoin, each new node joining the network or each transaction processed contributes to the network’s security and robustness, akin to how each new user of a tech product contributes to its data pool and utility. While companies like Facebook benefit from user data to sell targeted advertising, Bitcoin enhances its intrinsic value and security with each additional participant.

Moreover, despite not having a central authority to drive adoption, as seen with corporate marketing campaigns, Bitcoin’s decentralized model has allowed it to grow organically, driven by user adoption and the inherent benefits of its technology. This has not only propelled the price of Bitcoin but also cemented its status as a novel digital asset class, drawing parallels with the meteoric rise of tech companies based on network effects.

Bitcoin’s Adoption and Technological Growth

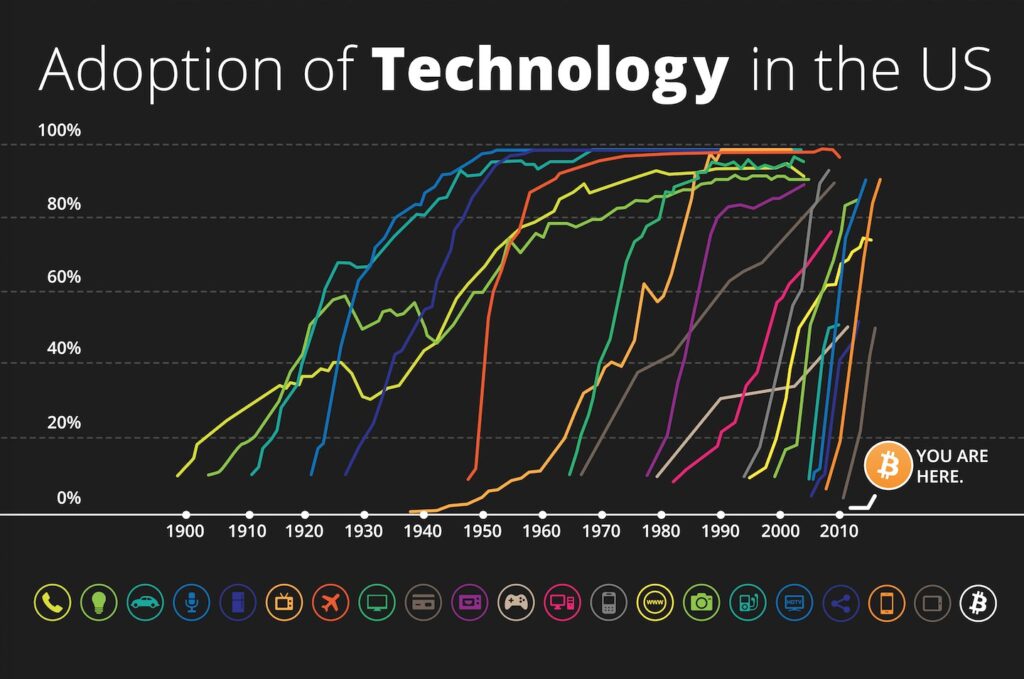

Bitcoin’s adoption trajectory mirrors the explosive growth of major technological innovations like the internet or smartphones, albeit on a different scale and context. Observing Bitcoin’s adoption next to these technologies underscores the rapidity and scale of its network effect.

The increasing hash power, reflecting the growing computational energy dedicated to mining and transaction verification, signifies enhanced network security and robustness. Active addresses and transaction volumes on the Bitcoin network offer tangible metrics reflecting user engagement and network utility, bolstering the perceived value of Bitcoin.

The implications of this growth are profound. Increased hash power and active addresses suggest a strengthening and deepening market for Bitcoin, influencing its price dynamics and investor perception. As the network expands, Bitcoin’s utility as a digital asset gains recognition, enhancing its appeal to a broader user base and solidifying its role in the emerging digital economy.

Comparatively, just as the advent of broadband internet catalyzed an explosion of online services and value creation, Bitcoin’s technological maturation and adoption could herald new paradigms in finance and beyond.

Future Outlook and Conclusion

Projecting into the future, Bitcoin’s network effects suggest a trajectory of continued growth and increasing relevance. Upcoming halving events, anticipated technological advancements, and broader societal shifts toward digital and decentralized solutions all bode well for Bitcoin’s future. While predicting specific outcomes remains speculative, understanding the network effect provides a robust model for Bitcoin, suggesting that as the network grows, so too will its value and utility in the global financial landscape.

Readers and participants in the crypto ecosystem are encouraged to share their perspectives on Bitcoin’s network effects, contributing to a broader dialogue on its future trajectory. Engaging with these ideas, whether through investment, research, or simple curiosity, underscores the evolving narrative of Bitcoin and its place in the digital age.