When it comes to cryptocurrency, Bitcoin stands out not only as the first but also as one of the most scrutinized digital assets in the market. Central to its valuation and market behavior is the Bitcoin 4-year cycle, also referred to as the Bitcoin halving or super cycle.

This bitcoin cycle revolves around a pivotal event that occurs approximately every four years, where the reward for Bitcoin mining — the process by which new BTC are introduced into the market — is halved. This event significantly impacts the supply of Bitcoin, creating a ripple effect across the crypto market and often heralding the onset of a new bull market phase.

The relevance of this market cycle extends far beyond mere speculation; it provides a lens through which investors and enthusiasts can gauge the future trajectory of Bitcoin’s value and market dynamics. As we approach the 2024 halving event, understanding this cycle becomes crucial for anyone involved in the crypto space, from the individual miner to the seasoned investor.

By analyzing past cycles, stakeholders can develop insights into potential market trends and prepare for the phases of accumulation, growth, correction, and recovery that characterize each cycle. In essence, the Bitcoin 4-year cycle offers a framework for navigating the complexities of the crypto market, providing a structured approach to understanding Bitcoin’s periodic fluctuations and long-term potential.

Understanding the Halving Event

The Bitcoin halving event transpires approximately every four years or after every 210,000 blocks have been mined. During this event, the block reward — the amount of Bitcoin awarded to miners for adding a new block to the blockchain — is halved. This halving cycles embedded in Bitcoin’s code, reduce the rate at which new bitcoins are created and, consequently, the total amount of Bitcoin that will ever be in circulation, capping it at 21 million.

The halving is a critical event because it significantly reduces the new supply of Bitcoin entering the market, which, assuming steady or growing demand, can lead to a supply shock and potential price increases. For instance, post the 2023 halving, the block reward decreased from 6.25 BTC to 3.125 BTC, affecting miners’ incentives and potentially the broader market dynamics, setting the stage for shifts in Bitcoin’s market valuation.

Phases of the Bitcoin 4 Year Cycle

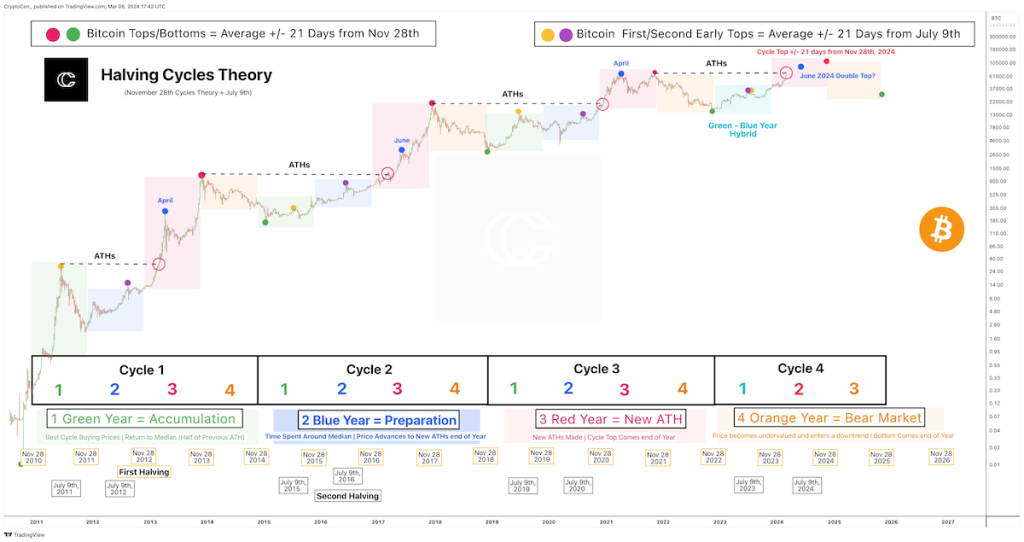

The cycle can be dissected into four distinct phases, each marked by unique market behaviors and investor sentiments. These phases are typically represented by different colors on a cycle chart, providing a visual representation of the market’s ebb and flow over time. The first phase, the accumulation year, is characterized by a generally bearish sentiment and lower prices, offering investors an opportunity to accumulate Bitcoin at lower valuations.

This is followed by the preparation year, which aligns with the halving event itself and sets the foundation for subsequent market movements. The subsequent bull market year often witnesses exuberant trading, culminating in reaching a new all-time high.

The cycle concludes with the bear market year, a period of correction and consolidation after the peak, as the market adjusts to the new price levels and begins the cycle anew. Each of these phases correlates with the halving events, providing a rhythm to Bitcoin’s market dynamics that stakeholders anticipate and react to.

Historical Bitcoin Price Performance Analysis

An examination of Bitcoin’s historical price performance through its past cycles reveals a pattern of significant price movements post-halving events. By analyzing color-coded charts that track Bitcoin’s price across different years, one can observe how each halving event typically precedes a substantial price rally, leading to a new all-time high. For example, following past halving events, Bitcoin has entered periods of accelerated growth, peaking at unprecedented levels before eventually retracting into a bear market phase.

These cycles offer an indicator of Bitcoin’s potential price trajectory, with the period after a halving often viewed as a prime phase for price appreciation. By understanding these patterns and their correlation with halving events, investors and market observers can gain insights into potential future market trends, helping to inform their strategies and expectations for Bitcoin’s performance in subsequent cycles.

Bitcoin Halving

The timing of market tops and bottoms within the Bitcoin 4-year cycle is a critical aspect of understanding Bitcoin’s price movements and overall market behavior. Historically, these pivotal points have shown a tendency to align with the Bitcoin halving events, albeit with a certain margin of error.

By examining the cycle, analysts have observed that market tops typically occur within a year following a halving, while market bottoms tend to form in the year preceding the next halving. This pattern suggests a cyclical nature of Bitcoin’s price, influenced significantly by the reduced block reward given to Bitcoin miners, which inherently impacts the supply side of the Bitcoin market.

By referencing specific cycle highs and lows, analysts aim to use historical data to predict future market behavior, providing valuable insights into potential investment strategies and market expectations surrounding each four-year cycle phase.

Implications of the Bitcoin Super Cycle

The Bitcoin 4-year cycle holds profound implications for many stakeholders within the cryptocurrency ecosystem. For investors, understanding the cycle’s phases can offer guidance on when to accumulate Bitcoin, anticipating price increases that typically follow halving events.

Bitcoin miners also face significant impacts, as the reduced block reward given to Bitcoin miners after each halving influences their profitability and could affect the amount of Bitcoin held by miners over time. Furthermore, the cycle affects the overall Bitcoin network, particularly in terms of security and participation in Bitcoin mining.

As the cycle progresses and if Bitcoin’s price increases, it can attract more participants to the network, enhancing security but also intensifying competition among miners. Understanding these dynamics is crucial for stakeholders to navigate the Bitcoin market effectively, leveraging the four-year cycle’s predictive aspects to inform investment decisions and strategies.

Future Outlook Within Halving Cycles

The analysis of the Bitcoin 4-year cycle provides critical insights into the rhythmic nature of Bitcoin’s market dynamics, influenced by the halving events that dictate the pace of new Bitcoin entering circulation. As the cryptocurrency ecosystem continues to evolve, understanding these cycles becomes paramount for anyone engaged in Bitcoin, whether they are investors, miners, or enthusiasts.

As we anticipate the next halving and its potential impacts on the Bitcoin price, the cryptocurrency community remains keenly observant of the patterns established over previous cycles, using them to forecast future movements.

We invite our readers to delve deeper into the nuances of the Bitcoin 4-year cycle, share their perspectives, and engage in discussions that enhance our collective understanding of Bitcoin’s market behavior. Your thoughts and predictions, grounded in historical analysis and current trends, contribute to a better dialogue around Bitcoin’s future.