ONDO Finance is rapidly emerging as a pivotal player in the cryptocurrency landscape, particularly in the niche of real-world asset tokenization. This innovative platform is designed to bridge the gap between traditional financial assets and the rapidly evolving world of blockchain technology.

By enabling the tokenization of assets like bonds and treasuries, ONDO is setting the stage for a more interconnected and accessible financial ecosystem. As we look toward the ONDO price prediction for 2024 and beyond, it’s clear that the integration of such real-world assets could significantly influence the crypto market dynamics by 2025 and lead into 2030.

The significance of ONDO Finance in the crypto space cannot be understated, especially with its strategic focus on institutional-grade finance solutions. The forecast for ONDO’s growth reflects a broader trend toward tokenization, which promises to enhance liquidity and transparency in financial markets.

This shift is not just a fleeting narrative but a robust technological advancement that ONDO is spearheading. As we delve into the ONDO price prediction for 2024 and the potential explosion in 2025, it’s crucial to understand how these technological innovations could reshape the financial landscape by 2030, making ONDO one of the top performing altcoins in the crypto sector.

Fundamental Analysis of ONDO Price Prediction 2024 – 2030

ONDO Finance positions itself uniquely in the cryptocurrency landscape as an onchain solution tailored for institutional-grade finance. This innovative platform facilitates the seamless integration of blockchain technology with traditional financial assets, enabling the tokenization of treasuries, bonds, and other securities. The significance of ONDO’s approach lies in its ability to provide blockchain solutions that meet the rigorous demands of institutional investors and major financial players.

Partnerships with leading financial institutions such as BlackRock and PIMCO underscore the transformative potential of ONDO. These collaborations not only lend credibility to ONDO’s platform but also pave the way for broader acceptance and integration of tokenized assets in mainstream finance. The impact of these partnerships is profound, as they help to bridge the gap between the emerging crypto market and the established financial sectors, potentially leading to more stabilized and liquid markets.

The real world asset tokenization offered by ONDO could revolutionize traditional sectors such as bonds and treasuries. By bringing these assets onto the blockchain, ONDO ensures greater transparency, efficiency, and accessibility, which are often limited in conventional settings due to bureaucratic and logistical constraints. This shift is expected to enhance the appeal of these assets, attracting more investors and increasing capital flow within the cryptocurrency market.

Price Forecast, Market Trends and Narratives

The trend towards real world asset tokenization is gaining momentum within the cryptocurrency market, driven by the growing recognition of its benefits by both technology enthusiasts and traditional financial entities. Major asset managers and financial giants are increasingly advocating for blockchain solutions that can enhance the liquidity and management of real assets. This push is part of a broader movement to modernize finance and make it more inclusive and efficient.

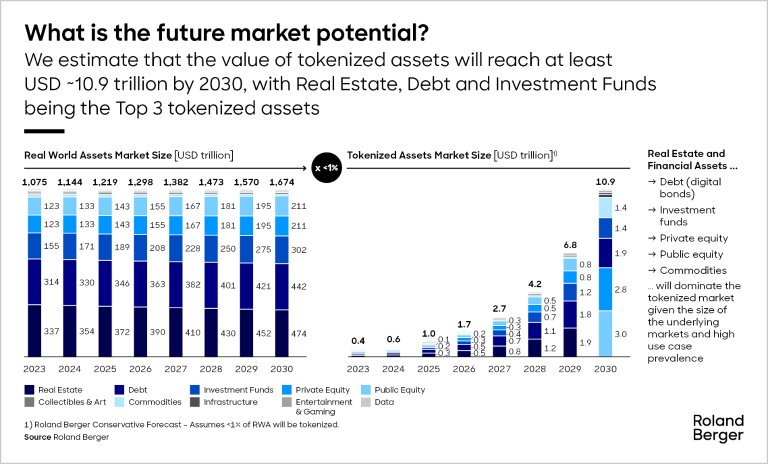

Current market size for tokenized real world assets shows promising growth, with projections indicating that it could reach over $10.9 trillion by 2030. This projection is not just optimistic speculation but is grounded in the increasing adoption rates and the expanding capabilities of blockchain technologies. As major players like BlackRock step into the crypto arena with initiatives like launching Ethereum-based funds for real world assets, the narrative around tokenization only grows stronger, reinforcing its inevitability in the future financial landscape.

Technical Analysis

Technical analysis of ONDO’s token reveals significant insights into its market behavior and potential future trajectory. A review of ONDO’s price history since its launch shows a pattern of volatility common in the cryptocurrency market, yet it also highlights substantial growth phases that align with key developments and partnership announcements. The current price of ONDO’s token has shown resilience in a fluctuating market, reflecting investor confidence and speculative interest.

Recent market performance indicates that ONDO has managed to sustain its market cap despite the inherent volatility of the crypto market, including the influences of external market forces such as fluctuations in Bitcoin prices.

Analyzing trading patterns and key price levels from the past months, we observe that ONDO has experienced resistance and support levels that are crucial for predicting future movements. Technical indicators suggest that if ONDO can maintain its current momentum and continue to capitalize on strategic partnerships, there could be significant upward price movements as the market heads towards 2026.

This technical analysis not only helps in understanding ONDO’s position in the cryptocurrency market but also assists investors in making informed decisions based on historical data and future forecasts. By keeping an eye on these technical aspects, stakeholders can navigate the complexities of the crypto market more effectively, leveraging volatility for potential gains.

The Team Behind ONDO Finance

The team behind ONDO Finance is a blend of seasoned finance professionals, blockchain experts, and visionary technologists. Their deep understanding of both the traditional financial markets and the evolving blockchain ecosystem has played a pivotal role in shaping ONDO’s strategic direction. The team’s expertise in Ethereum and other blockchain networks has been crucial in developing ONDO’s infrastructure, which is designed to facilitate seamless real-world asset tokenization.

Their proactive approach in forging partnerships with giants like BlackRock and PIMCO demonstrates their ability to navigate the complex landscape of institutional finance and cryptocurrency. These collaborations not only enhance ONDO’s credibility but also strengthen its position in the market. The strategic decisions made by this team are expected to continue driving innovation within ONDO, potentially leading to groundbreaking advancements in how traditional assets are managed and traded on the blockchain.

Tokenomics and Future Token Releases

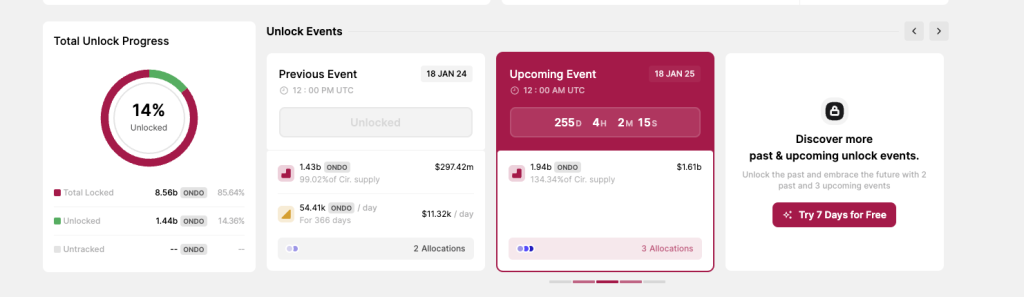

ONDO Finance’s tokenomics are carefully structured to balance the supply of tokens with market demand, ensuring sustainable growth. As of May 2024, the circulating supply of ONDO tokens plays a crucial role in its market dynamics. The total supply of ONDO is strategically released into the market, adhering to a planned schedule that mitigates the risk of inflation and supports a gradual price appreciation.

Significant upcoming events for ONDO include several token unlocks scheduled for September 2024, December 2024, and throughout 2025. These events could introduce substantial volumes of ONDO tokens into the market, potentially affecting the price. Investors should monitor these unlocks as they can lead to increased price volatility but also present opportunities for buying at lower prices before potential uptrends.

Price Predictions for 2025

The price predictions for ONDO in 2025 involve a range of scenarios from bearish to bullish, reflecting various market conditions. In a bearish scenario, if the crypto market faces a downturn, ONDO’s price could struggle to maintain its current levels. However, even in this case, the strong fundamentals of ONDO, supported by its robust tokenomics and strategic partnerships, might minimize any potential declines.

For the base scenario, assuming stable growth in the cryptocurrency market and successful integration of further real-world assets, ONDO’s price could see a moderate increase. Factors such as the expansion of Ethereum-based applications, including the potential success of Ethereum ETFs, might play a crucial role in this growth.

In the most bullish scenario, where the crypto market experiences a significant uptrend and ONDO successfully capitalizes on major institutional partnerships, the token could reach new heights. If ONDO manages to achieve a higher market cap and increased dominance within the crypto space, the price could surpass previous predictions, driven by both speculative interest and genuine utility gains.

These predictions should be considered with caution, as cryptocurrency investments are subject to high volatility and the risk of loss. Potential investors should research multiple viewpoints and be familiar with all local regulations before committing to an investment in ONDO or any other cryptocurrency.