The Bitcoin Halving is a pivotal event in the cryptocurrency world, occurring approximately every four years. This process is a fundamental part of Bitcoin’s design, serving as an anti-inflationary mechanism.

During the halving, the reward that Bitcoin miners receive for verifying transactions and adding new blocks to the blockchain is cut in half. This reduction directly impacts the rate at which new Bitcoin is introduced into circulation, effectively slowing down the inflation rate of the cryptocurrency.

Impact of the Bitcoin Halving on Miner Rewards

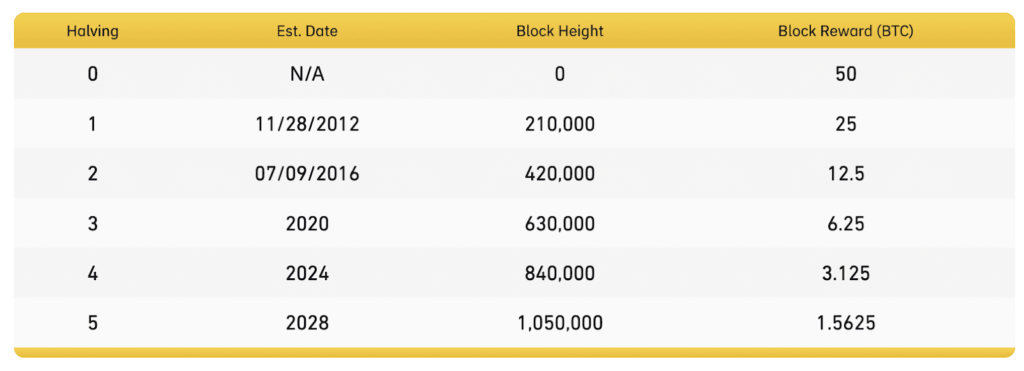

Initially, when Bitcoin was launched in 2009, miners received 50 Bitcoins per block. Since then, this reward has undergone several halvings, reducing first to 25, then to 12.5, and most recently to 6.25 Bitcoins per block.

The upcoming 2024 halving event will further reduce this reward to 3.125 Bitcoins per block. These halvings significantly impact miners’ earnings, as their reward for the same amount of mining work is halved.

The Significance of the 2024 Halving Event

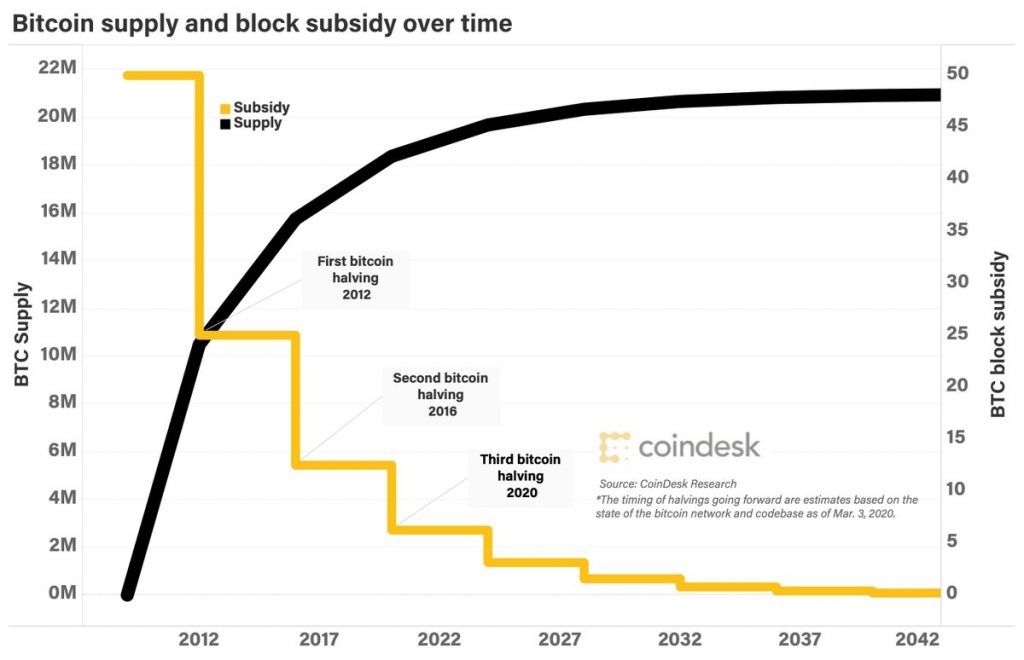

The 2024 Bitcoin Halving is particularly significant as it brings us closer to the cap of 21 million Bitcoins, the maximum supply set by Bitcoin’s protocol.

This scarcity is a key factor driving the price of Bitcoin, as reduced supply coupled with increasing demand can lead to price increases. The halving also symbolizes a critical phase in Bitcoin’s life cycle, transitioning from a phase of rapid expansion to a more mature, stable state.

Bitcoin Halving Cycle and Historical Price Movements

Historically, Bitcoin halving events have been precursors to substantial price movements. Typically, the price of Bitcoin has shown a significant increase following a halving event. For instance, post the 2016 and 2020 halvings, Bitcoin experienced considerable bull runs. Investors and market analysts closely watch these cycles, as they provide insights into potential future price trends.

Expected Changes in the Total Supply of Bitcoin

As we approach the 2024 halving, the total new Bitcoin entering circulation will continue to diminish. With the cap of 21 million Bitcoins ever to be mined, each halving event inches us closer to this limit. The decreasing supply of new Bitcoin is anticipated to have a deflationary effect on its value, making each Bitcoin potentially more valuable as they become rarer.

How Does the Bitcoin Halving Work?

The Role of Miners in the Halving Process

Miners play a crucial role in the halving process. They use powerful computers to solve complex mathematical problems, which in turn validates transactions and secures the Bitcoin network.

The halving event directly affects their incentives, as the reward for mining a block is reduced by half. This adjustment can impact the mining landscape, potentially leading to greater centralization as only the most efficient mining operations remain profitable.

Understanding the Block Reward and Inflation Dynamics

The block reward is the incentive for miners to maintain the network’s security. The halving of this reward is a deliberate design to control the inflation of Bitcoin.

By reducing the reward every four years, Bitcoin mimics the scarcity and value preservation typically seen in precious metals like gold. This deflationary mechanism contrasts with traditional fiat currencies, where central banks can print unlimited amounts of money.

Implications on the Bitcoin Network and Blockchain

The halving has significant implications for the Bitcoin network and blockchain. It ensures the long-term security and sustainability of the network by incentivizing miners through transaction fees as the block reward diminishes.

Additionally, the halving underscores the decentralized nature of Bitcoin, where monetary policy is predetermined and not subject to the whims of any central authority.

Price Movements and Market Reactions Surrounding Halving Events

Market reactions to Bitcoin halving events are often characterized by significant price movements. While the price could rise due to reduced supply, the market also factors in other elements like institutional adoption, regulatory changes, and macroeconomic conditions. Each halving event brings with it speculative interest, influencing the price of Bitcoin in both the short and long term.

The Relationship Between Halving Events and Bitcoin Price Rise

There is a noteworthy correlation between halving events and the subsequent rise in the price of Bitcoin. This correlation is partially attributed to the reduced rate of new Bitcoin entering the market, leading to a supply shock.

As demand continues to grow, especially from institutional investors, the reduced supply post-halving could further drive up the price. However, it’s essential to consider that cryptocurrency markets are influenced by a myriad of factors, and the halving is just one of them.

What to Expect from the Bitcoin Halving 2024?

As we approach the next Bitcoin halving in April 2024, market speculations suggest that the price of Bitcoin could experience significant fluctuations. Historically, halving events have led to substantial price increases due to the reduced rate of new Bitcoins entering circulation.

With the reward dropping from 6.25 BTC to around 3.125 BTC per block, the number of new Bitcoins created daily will decrease, potentially leading to a supply crunch. This reduction in supply, assuming steady or growing demand, is anticipated to positively impact Bitcoin’s price.

Exploring the Potential Effects on Bitcoin Miners and the Crypto Market

The halving will inevitably affect Bitcoin miners. The reduction in block rewards means that miners’ revenue will be halved, which could pressure less efficient mining operations. This event might trigger a restructuring of the mining landscape, favoring larger, more efficient miners.

The crypto market, on the other hand, might see heightened interest and investment, particularly if the price of Bitcoin surges post-halving, as has been observed in past halvings.

Insights into the 2024 Halving’s Influence on the Mining Landscape

The 2024 halving is expected to further consolidate the Bitcoin mining industry. The reduction in block rewards will likely necessitate more efficient mining technology and potentially lead to greater centralization. Furthermore, this halving could stimulate innovation in renewable and cost-effective energy sources for mining, as profitability becomes more challenging with lower rewards.

Anticipated Changes in the Block Reward and Total Bitcoin Supply

The halving will cut the block reward to approximately 3.125 BTC, directly influencing the total supply of new Bitcoins. As we inch closer to the maximum cap of 21 million Bitcoins, each halving event emphasizes the scarcity of Bitcoin. This scarcity is a fundamental aspect that could drive the price up, as the availability of new Bitcoins continues to diminish over time.

Expectations Surrounding ETF Approval and Bitcoin Halving

The Bitcoin Halving event could also influence the financial products tied to Bitcoin, such as a Bitcoin Spot ETF.

The combination of a halving event and the recent launch of a Bitcoin Spot ETF will attract more institutional investors, thereby increasing Bitcoin’s market demand and value.

Factors Affecting Bitcoin Price and Market Dynamics

The Relationship Between Halving Events and BTC Price

The relationship between Bitcoin halvings and the price of BTC is significant yet complex. Past trends suggest that halving events, which reduce the rate at which new Bitcoins are generated, have preceded major bull runs. However, it’s important to note that while halvings reduce supply, other market factors also play a crucial role in determining BTC’s price.

The Significance of the Securities and Exchange Commission’s Influence

The SEC’s role in the cryptocurrency market cannot be understated. Their decisions on matters like Bitcoin ETFs or regulatory guidelines for digital assets have substantial implications. Positive regulatory actions, such as the approval of the Bitcoin Spot ETF, will lead to increased investment in Bitcoin, especially from institutional investors, potentially driving up the price.

Predicting Price Movements and Scenarios Surrounding the Next Halving

Predicting precise price movements around the next Bitcoin halving in April 2024 is challenging due to the multitude of factors at play. However, based on historical data, it is plausible to expect a significant impact on Bitcoin’s price.

Potential scenarios range from a substantial bull run, as seen in previous post-halving periods, to more moderated growth influenced by broader market conditions.

Assessing Potential Long-term Effects on Bitcoin’s Network and Market Position

In the long term, the halving is likely to reinforce Bitcoin’s position as a scarce digital asset. As the reward for mining new blocks decreases and the total supply edges closer to the 21 million cap, Bitcoin could solidify its standing as “digital gold.”

This scarcity, coupled with increasing adoption and potential regulatory advancements, could strengthen Bitcoin’s network and market position in the years following the 2024 halving.

Preparing for the Bitcoin Halving: Investment and Mining Perspectives

Bitcoin investors and digital asset holders typically see Bitcoin’s halving as a critical event that can significantly impact the price and demand for Bitcoin. Historically, halving events have led to substantial increases in Bitcoin’s value, as they reduce the number of new Bitcoins entering circulation. Investors often adjust their strategies in anticipation of this event, considering the potential for increased value post-halving.

Strategies for Addressing Changes in Bitcoin’s Total Supply and Inflation

Investors might consider diversifying their portfolios with Bitcoin ETFs or increasing their holdings before the next halving event. The reduced rate of new Bitcoin creation post-halving could lead to deflationary pressure, making Bitcoin more attractive as a store of value. Investors need to understand these dynamics to make informed decisions.

Mining Perspectives: Evaluating the Implications for Miners and the Mining Landscape

For miners, the halving will halve the rewards for validating a block of Bitcoin, impacting profitability. Miners must evaluate the efficiency of their operations and may need to invest in more advanced technology to remain competitive. The halving could also lead to a consolidation in the bitcoin mining sector, favoring large-scale operations.

Exploring Potential Investment Opportunities Surrounding Bitcoin Halving 2024

The approaching halving presents potential investment opportunities. Historical trends show that the price of Bitcoin could reach new highs following the halving. Investors might explore various assets linked to Bitcoin, including ETFs and derivatives, to capitalize on this anticipated growth.

Insights into Historical Trends and Trade Strategies Related to Previous Halving Events

Analyzing historical trends is crucial for developing effective trade strategies.

The first halving event in 2012 and subsequent ones have all led to significant price increases over the following year. Investors should consider these patterns while also staying alert to current market dynamics and regulatory changes, like those from the Securities and Exchange Commission, that could influence the cryptocurrency market.

Navigating the 2024 Bitcoin Halving

As the 2024 Bitcoin halving draws near, both investors and miners must prepare for the shifts it will bring to the cryptocurrency landscape. This event is expected to reduce the number of new Bitcoins entering the market, potentially heightening demand and driving up prices.

For investors, exploring diversified strategies, including Bitcoin ETFs, and staying informed about regulatory changes are crucial steps. Miners, on the other hand, face a reduction in block rewards, necessitating efficiency upgrades and strategic planning.

Historically, Bitcoin halvings have marked significant turning points in the digital asset’s journey, making this upcoming event an essential milestone for all stakeholders in the Bitcoin blockchain ecosystem.