As we navigate through the volatile landscape of the crypto market, the quest for accurate Bitcoin price predictions becomes increasingly paramount. With the dawn of 2024 on the horizon and the years stretching out towards 2030, investors and enthusiasts alike are keenly focused on forecasts that attempt to chart the course of BTC’s value.

These predictions, ranging from conservative estimates to wildly optimistic figures, serve as a beacon for those looking to understand not just the immediate future in 2025 but also the long-term prospects leading up to 2030. The significance of these predictions lies not only in their ability to guide investment strategies but also in their reflection of the broader economic and technological factors at play within the crypto ecosystem.

The landscape of Bitcoin price prediction is a complex tapestry woven with various threads, including technological advancements, regulatory changes, market sentiment, and macroeconomic trends. As we stand on the cusp of 2024, looking ahead to 2025 and beyond, the anticipation around BTC’s price trajectory intensifies.

These forecasts are more than mere speculation; they encapsulate a wide array of analyses, from the mathematical to the fundamental, all aimed at deciphering the future value of Bitcoin. In this dynamic and often unpredictable market, understanding the factors that drive these predictions is crucial for anyone looking to navigate the crypto space successfully, whether they’re seasoned investors or newcomers drawn to the digital currency revolution.

ARK Invest’s Bitcoin Price Prediction 2030: A Comprehensive Overview

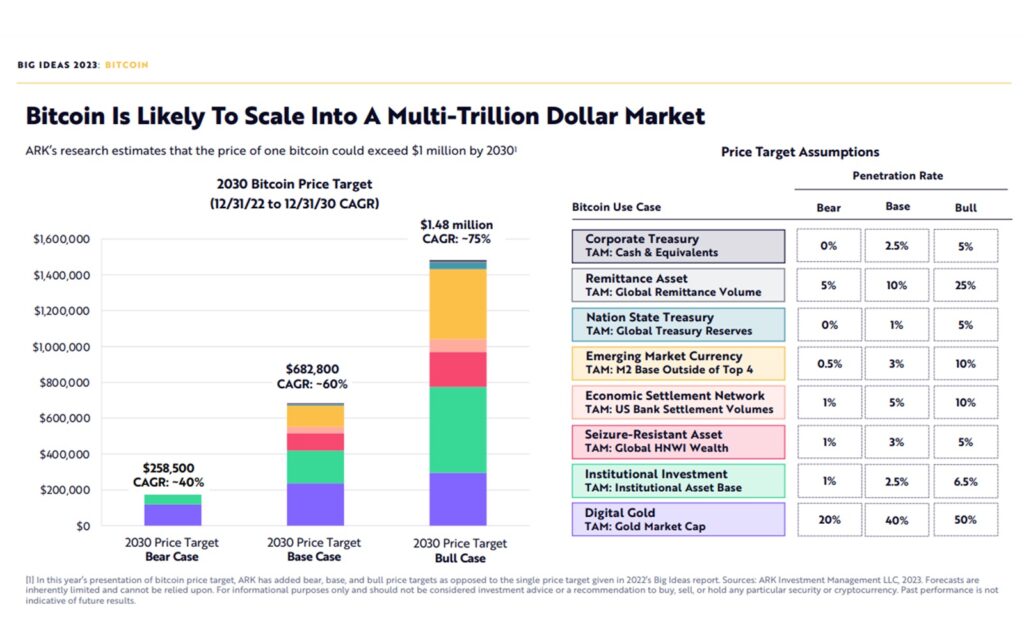

ARK Invest, renowned for its forward-thinking investment strategies, has released a compelling price prediction roadmap for Bitcoin, outlining scenarios that span from conservative to highly optimistic by the year 2030.

This analysis gains additional credence following the approval of their Bitcoin spot ETF, a significant milestone that underscores the growing institutional acceptance of Bitcoin, affecting the current price. ARK’s projections are categorized into three distinct scenarios: a bare case with the price of Bitcoin reaching $258,000, a base case forecasting $682,000, and a bullish scenario suggesting a future price of up to $1.48 million.

These price predictions for 2024 and beyond consider several factors, including the impact of the Bitcoin halving events, which historically have been precursors to substantial increases in Bitcoin’s price. The approval of a Bitcoin ETF is expected to further buoy the price, providing a regulated avenue for institutional and retail investors to buy Bitcoin, thus potentially driving up demand and, consequently, its price.

Use Cases and Market Penetration for BTC

The foundation of ARK Invest’s ambitious price targets for Bitcoin lies in the cryptocurrency’s expanding market penetration and its evolving use cases. Bitcoin is increasingly viewed as digital gold, a secure and accessible store of value within the Bitcoin market with the potential to rival the market cap of traditional gold, spurring lofty price appreciation forecasts.

Beyond its appeal as a hedge against inflation, Bitcoin’s utility is expanding into the realms of institutional investment and becoming an integral part of corporate treasuries, particularly following the Bitcoin ETF approval. Emerging markets, where Bitcoin acts as both a remittance asset and an alternative to unstable local currencies, underscore its growing role in global finance.

ARK’s analysis suggests that as Bitcoin continues to penetrate these markets—serving as everything from a seizure-resistant asset to an economic settlement network—its valuation will reflect its widespread utility and acceptance, justifying the optimistic price predictions for the future.

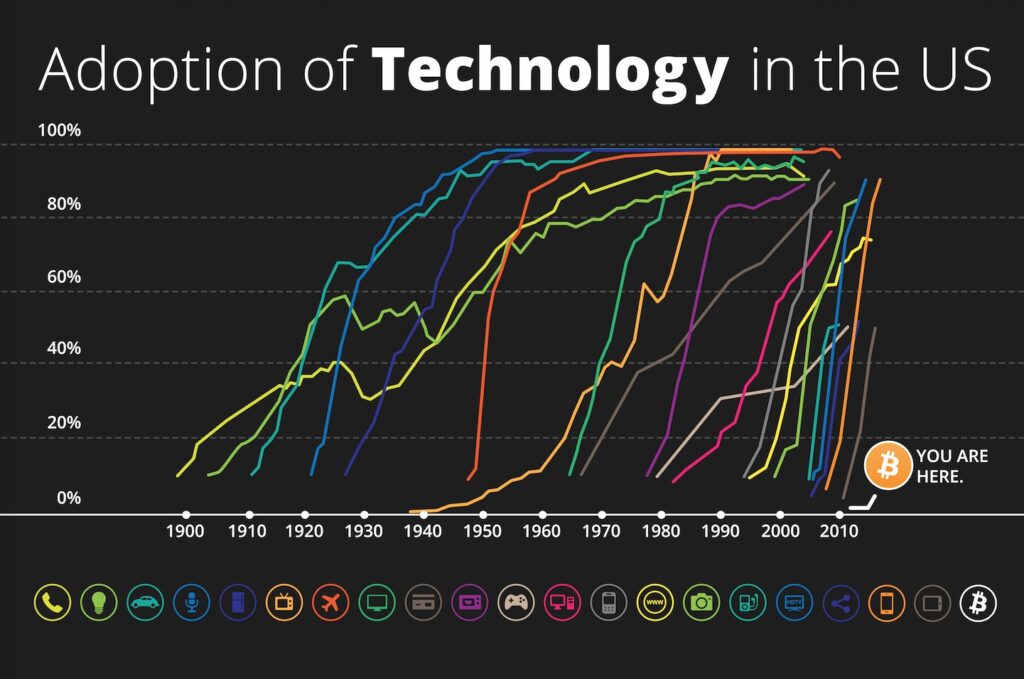

The Adoption Curve Comparison: Bitcoin Versus Traditional Technologies

When comparing Bitcoin’s adoption rate to that of transformative technologies such as mobile phones and the internet, a fascinating pattern emerges. Bitcoin’s current adoption trajectory mirrors the early stages of these technologies, suggesting a potential for exponential growth similar to what was observed with mobile and internet penetration.

This comparison is critical in understanding Bitcoin’s future price potential, with some suggesting it could reach 1.5 million by 2030. Mobile phones and the internet saw rapid adoption growth, becoming ubiquitous within a relatively short timeframe – a pattern that many theorize could be mirrored by the Bitcoin market influence the bitcoin price forecast. If Bitcoin follows a similar S-curve of adoption, the implications for its growth trajectory and, by extension, its Bitcoin prediction for significant price appreciation, are significant.

T years leading up to 2030 could witness an accelerated increase in Bitcoin adoption, driven by its growing acceptance as a mainstream financial asset and its utility across various sectors. This adoption rate comparison not only supports ARK Invest’s optimistic price predictions but also provides a framework to understand the potential scale and speed of Bitcoin’s integration into the global financial system.

Fidelity’s Adoption and Price Projection Model

Fidelity Investments, a titan in the global finance industry, has developed an intricate model that aligns the BTC price prediction with the adoption rates of pivotal technologies like mobile phones and the internet. This innovative approach offers a nuanced projection of Bitcoin’s value by 2030, juxtaposing BTC’s adoption curve against the historical penetration of mobile phone users and internet users per population.

Fidelity’s analysis suggests that if Bitcoin’s adoption trajectory mirrors these technologies, the average price of BTC could see exponential growth, leading to the potential value of 1.5 million by 2030. Their model projects an ambitious Bitcoin price prediction for 2030, hinting at a valuation significantly higher than the current Bitcoin price.

This forecast is grounded in the observation that newer technologies tend to achieve faster adoption rates, indicating that Bitcoin could potentially outpace the adoption speed of both the internet and mobile phones, thereby affecting its price action in a similarly accelerated manner.

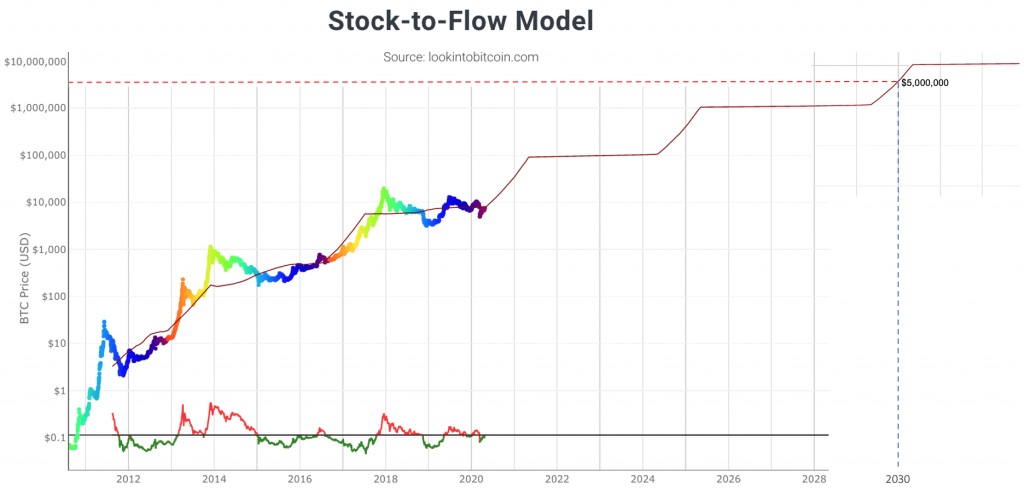

The Stock-to-Flow Model: Predicting Bitcoin’s Price Dynamics

The Stock-to-Flow (S2F) model, popularized by analysts in the crypto space, including figures like Cathie Wood of ARK Invest, offers another compelling lens through which to view Bitcoin’s future price movements.

This model, which measures the current stock of Bitcoin against the flow of new Bitcoins being mined, underscores Bitcoin’s scarcity and its impact on BTC price prediction. Particularly, the S2F model highlights the significance of Bitcoin halving events—periods when the reward for mining Bitcoin transactions is halved, approximately every four years. These events historically precede substantial bullish price action for BTC.

According to the S2F model, the post-2028 halving is expected to trigger a notable surge in Bitcoin’s price, with predictions reaching as high as $5 million per BTC by 2030. This projection aligns with the model’s interpretation of reduced supply and increased scarcity driving up the BTC price.

The Future of Bitcoin and Its Valuation

As we look towards the horizon of 2030, the future valuation of Bitcoin remains a subject of intense speculation and analysis. Various models, including those presented by ARK Invest and Fidelity, alongside the Stock-to-Flow model, offer a range of Bitcoin price predictions that reflect both the cryptocurrency’s potential for widespread adoption and its inherent scarcity.

Factors such as technological adoption rates, market penetration, and macroeconomic conditions will undeniably play critical roles in shaping the BTC price action. With the current bitcoin price serving as a baseline, these projections offer a glimpse into a future where Bitcoin could redefine the concept of value in the digital age.

As we consider these forecasts, it’s essential for enthusiasts, investors, and skeptics alike to engage in the ongoing dialogue, sharing predictions, insights, and analyses. The journey to 2030 promises to be filled with price movements that will test Bitcoin’s resilience, its status as a store of value, and its potential to revolutionize financial systems globally.