In the ever-evolving landscape of investment options, the debate between gold and Bitcoin as the ultimate store of value has captured the attention of investors worldwide. Gold, with its centuries-old history, has long been revered as a hedge against economic volatility and inflation, embodying stability and trust in the fluctuating world of finance.

Its tangible nature and finite quantity have established gold as a resilient and reliable asset, traditionally used for wealth preservation across generations. On the other hand, Bitcoin, the pioneering cryptocurrency, has emerged as a modern contender in the arena of wealth storage, challenging conventional perceptions with its digital essence and revolutionary blockchain technology. Despite its relative novelty and associated volatility, Bitcoin has quickly ascended as a significant investment option, drawing parallels to gold in terms of its scarcity and potential to act as a hedge against traditional stock market fluctuations.

As we delve into the battle for store of value between gold and Bitcoin, it’s crucial to explore the fundamental characteristics that define both assets. The comparison extends beyond their apparent differences, focusing on their roles in the context of exchange, investment, and wealth preservation.

While gold continues to leverage its historical significance and universal acceptance in exchanges around the globe, Bitcoin’s digital nature offers unprecedented portability, divisibility, and accessibility, marking a new era in how value is perceived and preserved. This introduction sets the stage for a deeper analysis of physical gold and Bitcoin, examining their unique attributes, market dynamics, and the evolving debate on which asset reigns supreme as the ultimate store of wealth in today’s digital age.

Comparing Characteristics: Bitcoin and Gold

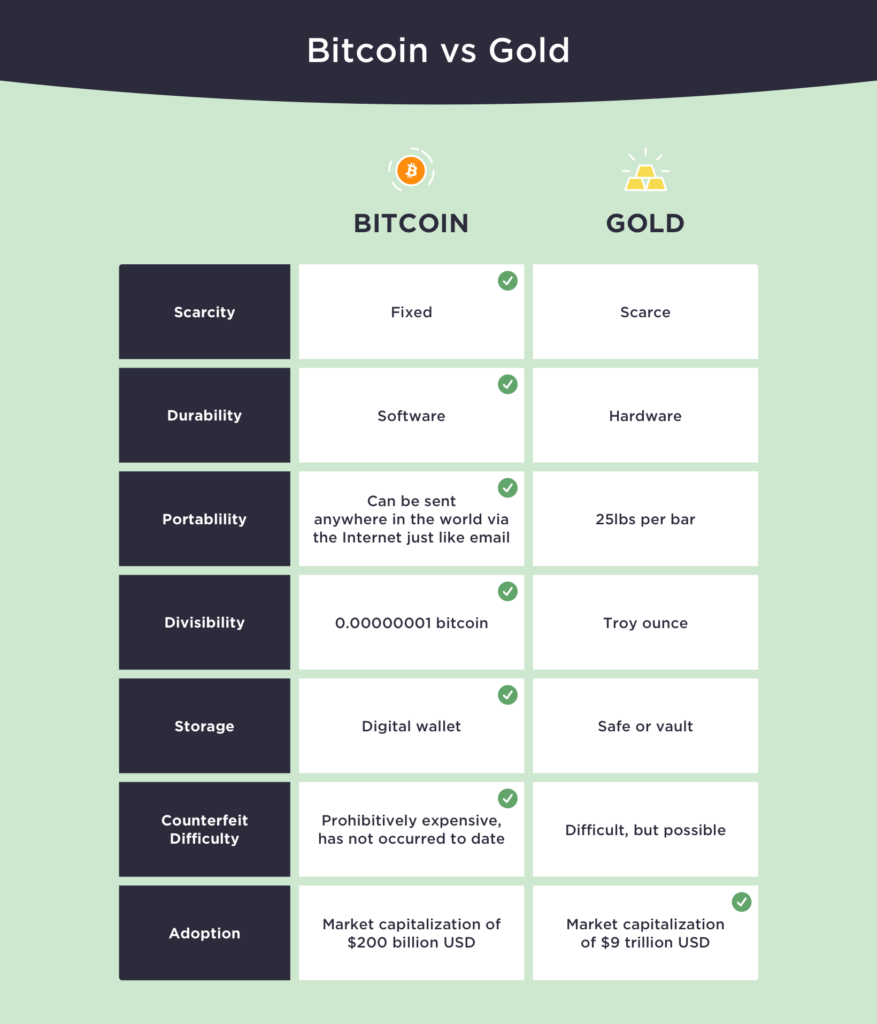

The debate between Bitcoin and gold as a store of value intensifies when examining their key attributes. Scarcity plays a pivotal role for both assets; gold has been a symbol of wealth for centuries due to its rarity, while Bitcoin’s appeal lies in its programmed cap of 21 million coins, making it a digital form of scarce resource.

Durability sees a divergence—physical gold has an enduring presence, resistant to decay, whereas Bitcoin’s durability is digital, existing on the blockchain indefinitely without physical wear and tear. Portability and divisibility further differentiate the two; Bitcoin can be transported across borders effortlessly and divided into smaller units (satoshis), making it highly adaptable for various transaction sizes. In contrast, gold’s physical nature limits its ease of transport and divisibility without losing value.

Storage presents another contrast; gold requires secure physical storage, which can be cumbersome and expensive, while Bitcoin is stored in digital wallets, accessible from anywhere with internet connectivity.

Counterfeit difficulty is inherent to both, yet their challenges differ; gold can be mimicked but not easily without expert knowledge, whereas Bitcoin, protected by cryptographic principles, has never been successfully counterfeited due to the blockchain’s security mechanisms.

Despite these differences, adoption remains critical for both; gold is universally recognized and held by central banks as reserves, reflecting its longstanding trust as a store of wealth. Bitcoin, although a recent entrant, has seen significant adoption among investors and is increasingly considered a hedge against inflation and fiat currency devaluation.

These characteristics underscore the unique value propositions of Bitcoin and gold, catering to the diverse preferences of investors seeking reliable stores of value.

Market Capitalization, Volatility & Adoption Rates

When comparing the market capitalization of Bitcoin and gold, the contrast is stark yet indicative of potential. Gold’s market cap, buoyed by centuries of accumulation and central bank reserves, dwarfs Bitcoin’s.

However, Bitcoin’s market value has seen explosive growth since its inception, a testament to its increasing acceptance and potential as a modern store of value. This rapid growth in market cap, despite Bitcoin’s youth, signals a shifting perspective among many investors towards cryptocurrencies as viable investment assets.

Adoption rates further illuminate this trend. Gold’s adoption is virtually universal, with a history as currency and continued accumulation by central banks around the world. Bitcoin’s adoption, while still in its nascent stages compared to gold, is accelerating, driven by its appeal as a liquid asset and its utility in digital transactions.

The increasing interest from institutional investors and the broader financial community in cryptocurrencies bolsters Bitcoin’s position as a contemporary counterpart to gold. This divergence in adoption rates not only highlights Bitcoin’s remarkable ascent in a short period but also underscores its potential to rival gold’s longstanding dominance as a preferred store of value.

The Mining Paradox: Gold and Bitcoin Supply Dynamics

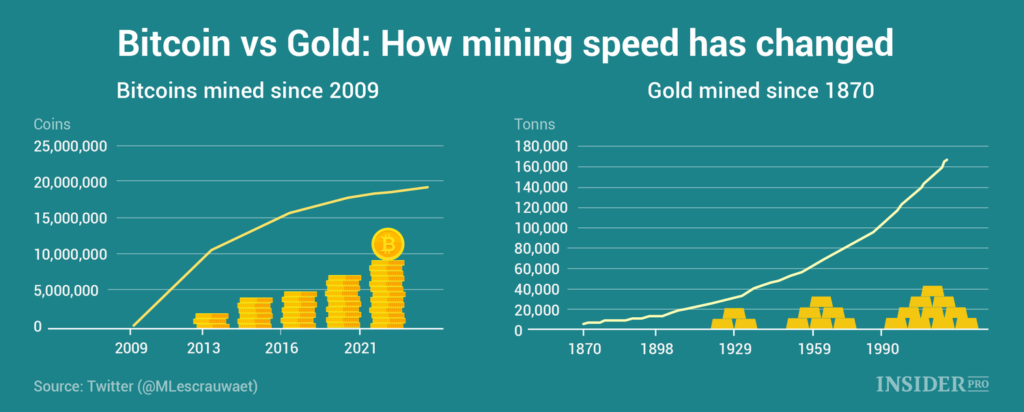

The mining processes of gold and Bitcoin reveal fundamental differences in their supply dynamics. Gold mining, a physical extraction process, has yielded a relatively steady annual increase in the price of gold, governed by the cost, labor, and environmental regulations.

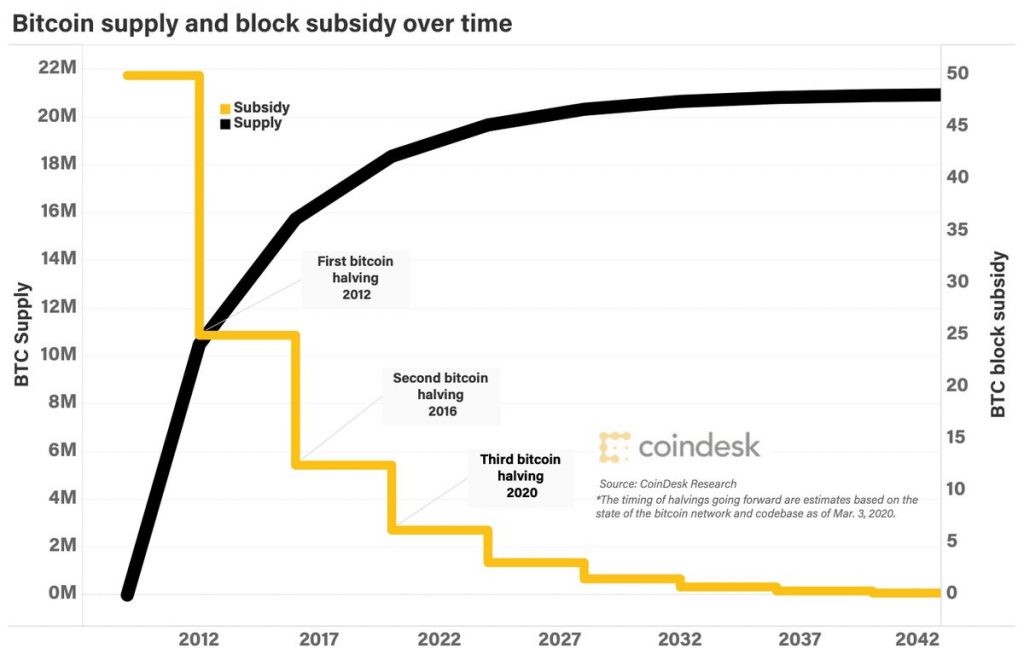

This gradual increase in supply has contributed to gold’s stability and enduring value. In contrast, Bitcoin mining is a digital process, where miners solve complex mathematical problems to validate transactions and secure the network, rewarded with new bitcoins. This process is capped by the Bitcoin protocol, which includes a halving event every four years, reducing the reward for mining new blocks and thereby slowing the rate at which new bitcoins are created.

This finite supply of Bitcoin, contrasted with gold’s more elastic but still limited annual yield, underscores a fundamental aspect of Bitcoin’s value proposition as a store of value: the predictability and transparency of its supply. Unlike gold, which can see fluctuations in its mining output based on technological, regulatory, or market changes, Bitcoin’s supply dynamics are predetermined, offering a unique form of scarcity akin to digital gold.

This distinction is crucial for investors considering the long-term value preservation qualities of both assets, with Bitcoin offering a novel approach to scarcity and value accrual in the digital age, challenging gold’s traditional role in the portfolios of those seeking to hedge against inflation and currency devaluation.

The Stock-to-Flow Model: Predicting Value Through Scarcity

The stock-to-flow model serves as a critical analytical tool in the Bitcoin vs. gold debate, offering insights into how the scarcity of these assets impacts their value. This model, highlighting the ratio of current supply against the production rate, reveals why both Bitcoin and gold are considered robust stores of value.

Gold, endorsed by the World Gold Council, boasts a high stock-to-flow ratio, underscoring its scarcity and enduring value through centuries. Similarly, Bitcoin’s predefined mining schedule, which halves the reward for Bitcoin mining approximately every four years, enhances its scarcity over time.

The stock-to-flow ratios of Bitcoin and gold are pivotal in assessing their investment portfolio viability, providing a quantitative measure of their scarcity and potential long-term value propositions. As Bitcoin approaches its maximum supply limit, its stock-to-flow ratio escalates, drawing parallels with gold and positioning it as a digital counterpart in investment strategies.

Which is The Better Investment? Bitcoin vs. Gold

When evaluating Bitcoin vs. gold as a better investment, the return on investment (ROI), especially against the backdrop of the expanding US money supply, becomes a crucial consideration. Analysis of both assets since Bitcoin’s inception reveals a dynamic performance landscape.

Bitcoin transactions and the asset’s digital nature offer a unique blend of accessibility and divisibility, potentially leading to superior ROI compared to gold prices over the same period. Data, potentially sourced from entities like the World Gold Council, illustrates gold’s steady performance as a hedge against inflation.

However, Bitcoin’s remarkable ascent, despite its volatility, suggests a potent capacity for wealth generation, challenging traditional investment strategies. This comparative analysis prompts investors to weigh Bitcoin vs. gold within their investment portfolios, contemplating which one is a better investment based on historical performance and future potential.

The Future of Wealth Preservation

Looking ahead, the roles of Bitcoin and gold in wealth preservation are subject to evolving macroeconomic factors, technological advancements, and shifts in investor sentiment. This discussion invites readers to ponder the gold or bitcoin dilemma, considering each asset’s merits and limitations as part of a diversified investment strategy.

Gold’s tangible allure and historical precedent contrast with Bitcoin’s digital innovation and finite supply, each presenting compelling arguments for inclusion in investment portfolios. As the investment landscape navigates through uncertainties and opportunities, the debate between Bitcoin vs. gold will likely persist, influenced by global economic policies, investor preferences, and emerging financial technologies.

Ultimately, the decision on which is a better investment rests with individual investors, who must align their choices with personal risk tolerance, financial goals, and outlooks on the future of money and value preservation.