In 2024, the landscape of cryptocurrency and blockchain technology continues to evolve, propelled by a myriad of compelling narratives that shape industry perception and direction.

These crypto narratives for 2024 serve as a crypto narrative tracker, providing insights into the narrative crypto meaning behind market movements and trends.

Understanding the prevailing crypto narratives is essential for informed decision-making as investors and enthusiasts navigate the dynamic crypto landscape.

By exploring the top crypto narratives for 2024, stakeholders gain valuable insights into the forces driving the crypto market’s trajectory, facilitating a deeper understanding of the opportunities and challenges that lie ahead.

In this blog, we will be discussing:

- Artificial intelligence

- GameFi

- Meme Coins

- Solane Ecosystem

- BRC-20

- Real World Assets

- Layer 1

- Ethereum Ecosystem

- Avalanche Ecosystem

- NFTs

- DePIN

- Smart Contract Platforms

Key Takeaways

- Crypto narratives for 2024 serve as a vital tracker of industry trends, guiding investors and enthusiasts through the dynamic landscape of cryptocurrency and blockchain technology.

- Understanding these narratives is essential for informed decision-making, as they shape market sentiment, drive innovation, and influence adoption trends within the crypto space.

- The top crypto narratives for 2024 include integration of artificial intelligence (AI), the rise of decentralized finance (DeFi), the tokenization of real-world assets (RWAs), and the emergence of crypto gaming as significant market segments.

- These narratives underscore the industry’s focus on accessibility, scalability, and usability, with a growing emphasis on user experience and the fusion of blockchain technology with other emerging technologies.

- By embracing and understanding these narratives, stakeholders can strategically position themselves to capitalize on the opportunities presented by the evolving crypto industry, paving the way for a more decentralized, accessible, and innovative future in cryptocurrency.

Why Are Crypto Narratives Important?

Crypto narratives are crucial because they shape the cryptocurrency market’s perception, direction, and behavior. Here’s why they are essential:

Influence on Investor Sentiment

Crypto narratives influence how investors perceive different market projects, tokens, or trends. Positive narratives can generate enthusiasm and attract investment, while negative narratives can lead to skepticism and sell-offs.

Highlight Technological Innovations

Narratives often revolve around technological advancements like DeFi, NFTs, or Layer 2 solutions. These narratives draw attention to innovative projects and concepts, driving development and adoption within the crypto ecosystem.

Fuel Growth and Enthusiasm

Strong narratives can fuel the growth of specific projects or sectors within the crypto space. For example, narratives around the potential of blockchain technology to revolutionize finance have contributed to the rapid expansion of DeFi.

Drive Investment and Adoption Trends

Crypto narratives can influence investment decisions and adoption trends. For instance, narratives around the potential of blockchain technology in gaming (GameFi) have attracted developers and users to blockchain-based gaming platforms.

Reflect Market Dynamics

Crypto narratives often reflect broader market dynamics, such as bull runs, regulatory developments, or macroeconomic trends. Understanding these narratives can provide insights into market sentiment and potential future trends.

Top Crypto Narratives for 2024

Overall, crypto narratives play a crucial role in shaping the evolution of the cryptocurrency market, driving innovation, investment, and adoption across various sectors and technologies within the blockchain space.

Artificial Intelligence

Artificial intelligence (AI) continues revolutionizing crypto, enhancing efficiency and innovation. Its applications are vast and transformative, from generative AI in NFT creation to AI-driven trading strategies. As AI agents evolve, they contribute to market analysis, risk assessment, and personalized user experiences, shaping the crypto industry’s future.

Crypto investors are looking to profit from AI by identifying two types of crypto projects:

- Projects that support AI operations

- Projects that create AI solutions and provide AI services

GameFi

GameFi merges blockchain with gaming, granting players real ownership of in-game assets and the chance to earn rewards—projects like Axie Infinity pioneer GameFi, building decentralized economies within gaming ecosystems. With play-to-earn models and interoperable assets rising, GameFi transforms gaming, drawing in gamers and investors.

In GameFi, players establish economies around in-game items and currencies, mirroring physical product tradability in the digital realm. Like physical items, digital assets in GameFi are seamlessly owned and traded. It’s not just about replacing traditional work with gaming but also empowering players and enhancing their gaming experiences through ownership and participation.

Ultimately, GameFi bridges the physical and digital worlds, offering players a newfound sense of ownership and engagement in their favorite games.

Meme Coins

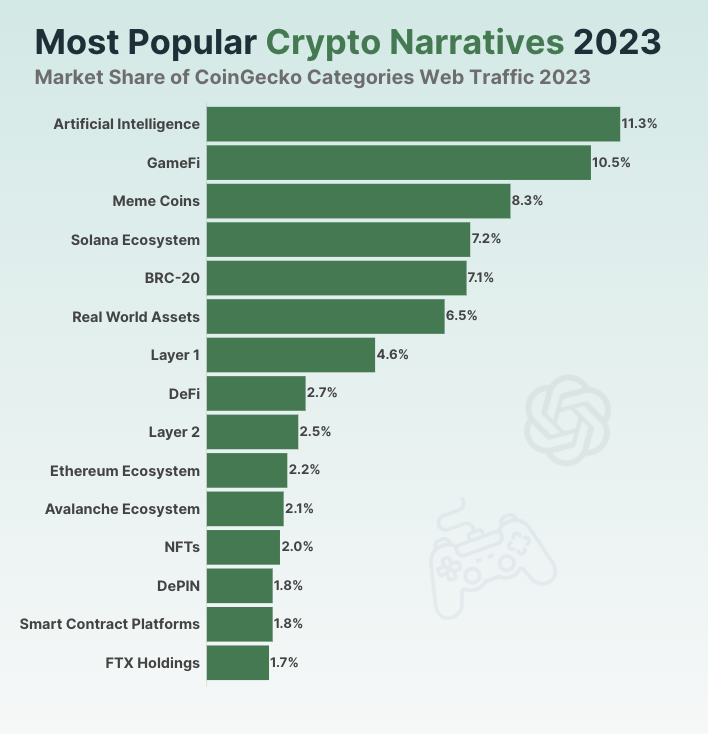

Meme coins, known for their viral nature and community-driven hype, capture the attention of crypto enthusiasts. Despite being seen as speculative, coins like Dogecoin and Shiba Inu showcase the influence of social media in shaping market trends. Meme coins held an 8.3% share, ranking third in popularity. 2023 witnessed an extended meme coin season, with coins like Pepe (PEPE) and Bonk (BONK) seeing significant gains.

Despite their volatility, meme coins remain an integral part of the crypto narrative, embodying the democratization and entertainment aspects of the industry.

Solana Ecosystem

The Solana ecosystem stands out as a strong contender in the blockchain space, providing high throughput and affordable transactions. Spanning DeFi, NFTs, and gaming projects, Solana appeals to developers and users seeking scalability and efficiency. Its dynamic ecosystem encourages innovation and adoption, solidifying Solana’s position as a key player in the crypto landscape

BRC-20

BRC-20 tokens, built on the Binance Smart Chain, facilitate various functionalities within decentralized applications (DApps) and smart contracts. Like ERC-20 tokens on Ethereum, BRC-20 tokens enable seamless tokenization and interoperability across platforms, fueling the growth of decentralized finance (DeFi) and other blockchain-based initiatives.

Real World Assets

Tokenizing real-world assets (RWA) on the blockchain unlocks liquidity and accessibility previously unattainable in traditional markets. From real estate to commodities, blockchain technology enables fractional ownership and efficient transfer of assets.

As the crypto industry bridges the gap between the digital and physical worlds, real-world assets are pivotal in expanding investment opportunities and decentralizing finance.

The top 10 RWA cryptos by market capitalization are:

- Ondo (ONDO)

- Centrifuge (CFG)

- Pendle (PENDLE)

- Polymesh (POLYX)

- Mantra (OM)

- LCX (LCX)

- Creditcoin (CTC)

- Dusk (DUSK)

- Maple (MPL)

- AllianceBlock Nexera (NXRA)

Layer 1

Layer 1 protocols serve as the foundational layer of blockchain networks, providing security, consensus mechanisms, and transaction processing capabilities. Networks like Ethereum, Avalanche, and Solana operate as Layer 1 solutions, hosting decentralized applications (DApps) and enabling smart contracts.

As scalability and interoperability become paramount, Layer 1 protocols evolve to meet the demands of a rapidly expanding ecosystem.

Ethereum Ecosystem

In the Ethereum ecosystem, at the forefront of blockchain innovation, Ethereum continues to drive narratives in crypto. Despite challenges like scalability and gas fees, Ethereum remains a mainnet for crypto narratives in 2024. With upgrades like Ethereum 2.0 and Layer 2s like optimism, the ecosystem aims to shape the crypto industry, offering new highs and addressing concerns about transactions off-chain.

As we explore Ethereum’s role in decentralized physical infrastructure networks and liquid staking, showcasing its modularity and potential to disrupt traditional gaming. As a leader in the crypto industry in 2024, Ethereum continues to attract the crypto community and shape significant narratives with its innovative approach to blockchain technology.

Avalanche Ecosystem

Avalanche emerges as a promising Layer 1 protocol, offering high throughput and low latency for decentralized applications (DApps) and financial services. Its subnets and cross-chain interoperability facilitate seamless asset transfers and foster innovation across various sectors.

With projects like Avalanche Rush incentivizing adoption and liquidity provision, the Avalanche ecosystem continues to expand, attracting developers and users seeking scalability and efficiency.

NFTs

Non-fungible tokens (NFTs) revolutionize digital ownership by enabling unique and verifiable ownership of digital assets, including Bitcoin. They unlock new possibilities for creators and collectors, driving innovation in the crypto space. With platforms like OpenSea and Rarible, NFTs democratize access to digital assets and redefine the relationship between creators and consumers.

Leveraging the security and immutability of blockchains, NFTs provide a transparent and decentralized method for proving ownership and authenticity. Their modular nature allows for interoperability across blockchains, enhancing their utility and versatility.

Wallet solutions tailored for NFTs ensure secure storage and management of digital assets, facilitating easy access and transferability. Integrating physical infrastructure into NFTs further expands their impact in the crypto space by tokenizing real-world assets and connecting them to blockchain ownership..

DePIN

DePIN, or Decentralized Personal Identification Number, represents a novel approach to secure authentication on the blockchain. By leveraging decentralized identity solutions, DePIN enhances privacy and security in digital transactions, eliminating the need for centralized authentication authorities.

As identity theft and data breaches become increasingly prevalent, DePIN offers a decentralized alternative, empowering users to control their data and access digital services securely.

The top 10 DePIN cryptos by market capitalization are:

- Filecoin (FIL)

- Render (RNDR)

- Arweave (AR)

- Theta network (THETA)

- Helium (HNT)

- Akash Network (AKT)

- Iota (IOTA)

- Iotex (IOTX)

- Holo (HOT)

- Siacoin (SC)

Smart Contract Platforms

Smart contract platforms like Ethereum and Cardano revolutionize agreements and transactions by enabling programmable, self-executing contracts. They power decentralized applications (DApps) and decentralized finance (DeFi), offering a foundation for innovative financial services.

With advancements in security and scalability, these platforms drive blockchain adoption across industries. In 2024, they’re poised to challenge assumptions and explore new frontiers like tokenizing precious metals. Advancements like zero-knowledge proofs enhance privacy, guiding users through the evolving crypto landscape.

The Future of Crypto Market

The future of the crypto market holds immense promise, driven by a convergence of factors outlined in the given keyword list. As artificial intelligence (AI) integrates with blockchain technology, we anticipate more sophisticated trading strategies, enhanced security measures, and personalized user experiences. GameFi revolutionizes the gaming industry, offering players ownership of in-game assets and novel monetization opportunities.

The emergence of meme coins underscores community-driven narratives in shaping market dynamics within the crypto space. With advancements in scalability, interoperability, and security across Layer 1 protocols like Ethereum and Avalanche, coupled with the tokenization of real-world assets, the crypto market is poised for further expansion. NFTs redefine digital ownership, while smart contract platforms enable programmable agreements, fostering innovation and accessibility.

Market Trends and Technologies to Watch Out in 2024

Restaking Tokens

Restaking tokens involves reinvesting earned rewards from staking into the same cryptocurrency to compound returns. This practice enhances the yield of staked assets, encouraging long-term holding and participation in blockchain networks’ security and governance mechanisms.

DePIN

DePIN, or Decentralized Personal Identification Number, offers a decentralized approach to secure authentication, enhancing privacy and security in digital transactions. By leveraging decentralized identity solutions, DePIN empowers users to control their data and access digital services securely, mitigating risks associated with centralized authentication authorities.

Real-World Asset Tokenization

Real-world asset tokenization involves representing tangible assets such as real estate, commodities, or artwork as digital tokens on blockchain networks. This process unlocks liquidity and accessibility previously unavailable in traditional markets, enabling fractional ownership, efficient transfer, and broader investment opportunities in physical assets.

Data Availability Layers

Data availability layers enhance the scalability and efficiency of blockchain networks by optimizing data storage and accessibility. These layers facilitate the secure and transparent storage of transaction data off-chain while maintaining on-chain integrity, ensuring reliable and cost-effective data management for decentralized applications (DApps) and smart contracts.

Artificial Intelligence

Integrating artificial intelligence (AI) with blockchain technology enhances efficiency, security, and innovation across various industries. AI-driven algorithms optimize data analysis, risk assessment, and personalized user experiences, enabling sophisticated trading strategies, improved security measures, and streamlined processes in decentralized applications (DApps) and financial services powered by blockchain networks.

Investment Decisions and Strategies

When contemplating investment decisions and strategies in cryptocurrency, one’s choice of narrative hinges on a myriad of factors, including risk tolerance, investment objectives, and prevailing market conditions. Nevertheless, certain narratives may hold greater allure or suitability for confident investors or particular scenarios:

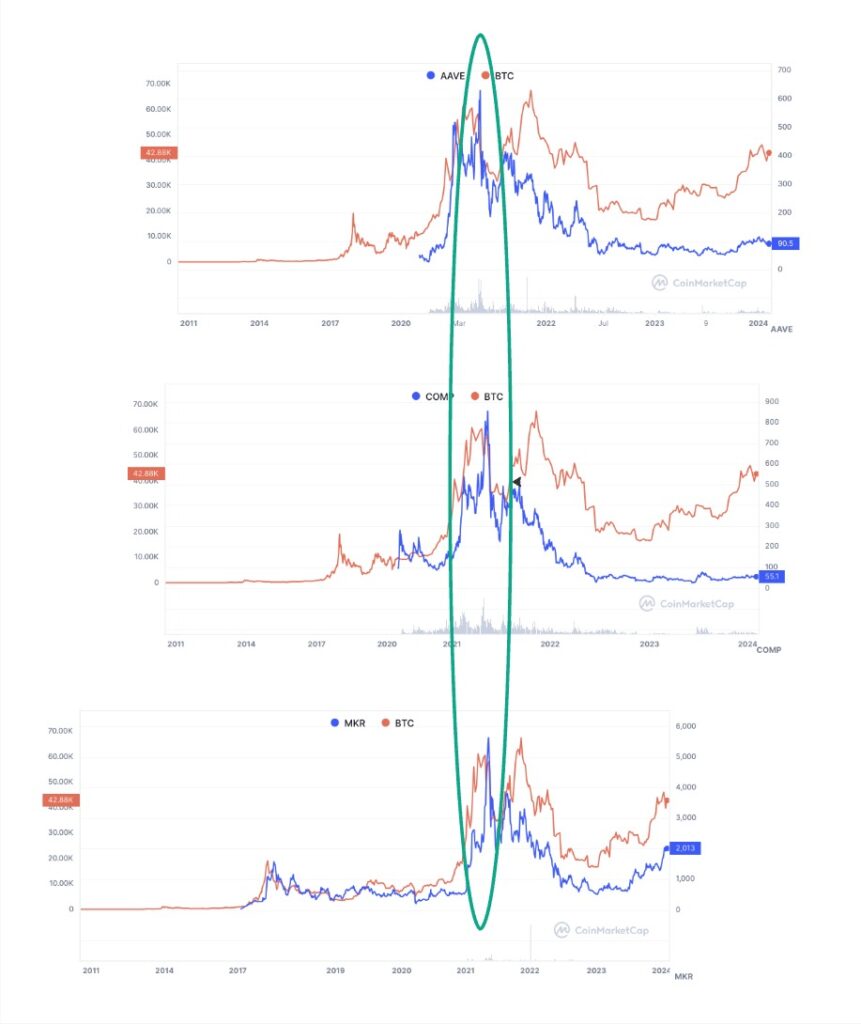

DeFi Dominance

Investors aiming for substantial returns and willing to embrace elevated risks may gravitate towards narratives spotlighting decentralized finance (DeFi). This narrative spotlights blockchain’s capacity to revolutionize traditional finance through inventive financial products and services.

NFT Boom

Individuals intrigued by digital art, collectibles, or the gaming sector might find narratives surrounding non-fungible tokens (NFTs) particularly captivating. NFTs epitomize unique digital assets and have garnered attention as a means to tokenize ownership of digital content.

Blockchain Integration with AI

Those intrigued by technological innovation and long-term potential may center their focus on narratives exploring the fusion of blockchain with artificial intelligence (AI). This narrative underscores the symbiosis between these technologies and their potential to revolutionize diverse industries.

Real-World Asset Tokenization

Investors prioritizing stability and portfolio diversification may be drawn to narratives surrounding the tokenization of real-world assets. This narrative harnesses blockchain technology to represent ownership of tangible assets such as real estate, commodities, or artwork.

Mainstream Adoption

Narratives spotlighting mainstream adoption and institutional engagement in crypto could resonate with investors seeking validation and stability in the market. This narrative underscores developments such as introducing cryptocurrency ETFs, acceptance by traditional financial institutions, or regulatory clarity.

Ultimately, the most suitable narrative for investment decisions and strategies is contingent upon individual preferences, risk appetite, and the investor’s market trends and opportunities assessment. Embracing diversification across multiple narratives may also serve as a prudent approach to mitigate risk and capture potential upside across various sectors of the cryptocurrency market. Additionally, recognizing the significance of cryptocurrencies as a store of value, the disruptive potential of blockchain technology, and the incentives offered by blockchains and token rewards can further inform investment strategies and decisions in the dynamic crypto landscape.

Conclusion

In summary, the top crypto narratives for 2024 depict a rapidly evolving landscape within the cryptocurrency industry. These narratives serve as a tracker, enabling investors and enthusiasts to anticipate future trends. From AI integration to DeFi decentralization and real-world asset tokenization, these narratives underscore the industry’s dynamism and growth potential.

Looking ahead, understanding these narratives is crucial, as they promise to revolutionize various facets of the industry and offer new opportunities for participation. The emergence of crypto gaming, digital asset tokenization, and the focus on user experience further highlights the industry’s direction toward accessibility, scalability, and usability.

By embracing these narratives, stakeholders can strategically position themselves to capitalize on the opportunities presented by the evolving crypto industry, paving the way for a more decentralized, accessible, and innovative future in cryptocurrency.