In the ever-evolving world of cryptocurrency, a burning question captures the imagination of both seasoned traders and curious onlookers alike: “How many people own one full Bitcoin?”

It’s a query that not only probes the depths of Bitcoin’s market penetration but also shines a light on the fascinating dynamics of wealth distribution within the realm of digital currency.

Imagine, out of the billions of people on this planet, how many have staked a claim in this digital gold rush by owning at least one full BTC?

This question is more than just a statistical curiosity; it’s a gateway into understanding the allure and significance of Bitcoin in today’s economy. With Bitcoin’s meteoric rise from a niche internet oddity to a globally recognized financial asset, owning 1 BTC has become a symbol of foresight and financial acumen.

As we unravel the numbers and trends behind Bitcoin ownership, you’re about to discover not just the raw data but the stories and implications that these figures represent.

How Many People Own At Least One Full Bitcoin?

Determining the exact number of individuals who own at least one full Bitcoin (BTC) is a complex task, owing to the decentralized and private nature of cryptocurrency transactions. However, a closer look at the Bitcoin network’s data provides some insights.

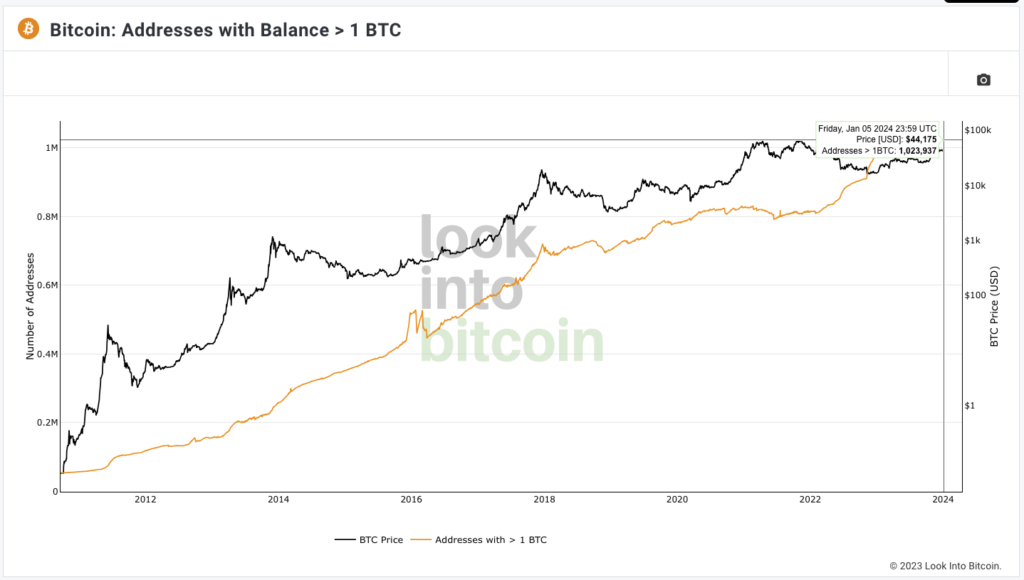

As of early 2024, over 1 million Bitcoin addresses hold a balance of 1 BTC or more. This significant milestone underscores the growing interest in Bitcoin as an asset. However, it’s crucial to differentiate between Bitcoin addresses and actual owners. A single individual can control multiple Bitcoin wallet addresses, each holding fractions or multiple units of BTC.

This makes the direct correlation between the number of addresses and the number of individuals owning 1 BTC less straightforward. Nonetheless, the figure of 1 million addresses with at least 1 Bitcoin offers a glimpse into the cryptocurrency’s reach and the level of investment in the asset.

Number of Bitcoin Owners

To estimate the number of Bitcoin owners possessing at least 1 BTC, we must consider the relationship between Bitcoin wallet addresses and individual owners. With over 1 million Bitcoin addresses holding 1 BTC or more, and considering that many individuals use multiple addresses, we can infer that the actual number of unique Bitcoin owners is less than this figure.

Glassnode, a blockchain analytics firm, suggests that on average, one entity controls about 31.5 Bitcoin addresses. Applying this average to the 1 million-plus addresses, we get a rough estimate of around 32,000 individuals owning at least 1 BTC.

However, this number is a conservative estimate and does not account for the numerous Bitcoin holders who might have accumulated 1 BTC across several addresses, each holding less than 1 BTC.

Percentage of Bitcoin Owners

In terms of global population, the percentage of individuals owning at least one full Bitcoin is minuscule. Even with over 1 million Bitcoin addresses holding 1 BTC, the actual number of unique owners is significantly smaller.

Based on the assumption that each person may control multiple addresses, the percentage of the world’s population owning 1 BTC is around 0.002%. This low percentage highlights the rarity of Bitcoin ownership, largely due to the limited supply of 21 million coins and the uneven distribution of wealth within the cryptocurrency space.

As Bitcoin continues to gain mainstream acceptance and its market capitalization grows, this percentage might increase, reflecting a broader participation in the crypto market.

Market Capitalization of Bitcoin

The market capitalization of Bitcoin, a crucial indicator of its financial significance, represents the total value of all Bitcoins in circulation. As of early 2024, Bitcoin’s market cap has seen substantial growth, reflecting the increasing investment in this cryptocurrency.

The market cap is calculated by multiplying the current market price of Bitcoin by the total number of BTC in circulation. This metric provides insight into the overall economic weight of Bitcoin within the broader financial landscape, including its comparative size against other cryptocurrencies and traditional asset classes.

The growing market cap of Bitcoin also signifies its rising acceptance as a legitimate and valuable asset, both among retail and institutional investors.

Bitcoin Adoption and Ownership Trends

The adoption and ownership trends of Bitcoin have evolved significantly since its inception. Initially, Bitcoin was a niche interest among tech enthusiasts and libertarians. However, over the years, it has gained mainstream attention, with a noticeable increase in the number of Bitcoin wallets and addresses holding 1 BTC or more.

This trend is indicative of a broader acceptance of Bitcoin as a legitimate component of a diversified investment portfolio. The adoption curve of Bitcoin also reflects its growing recognition as a ‘digital gold’, with individuals and institutions looking to BTC as a store of value and a hedge against traditional market fluctuations.

The trends in Bitcoin ownership also mirror the overall growth and maturation of the cryptocurrency market, with Bitcoin often leading the way in terms of innovation and adoption.

What is the Significance of Owning One Full Bitcoin?

Owning one full Bitcoin has become a symbolic milestone in the cryptocurrency community. This achievement is not just a financial investment but also signifies a belief in the long-term potential of Bitcoin as a digital asset.

As the supply of Bitcoin is capped at 21 million, owning 1 BTC places an individual among a limited group of holders. This scarcity adds to the allure of owning a full Bitcoin, making it a coveted asset in the crypto space. Additionally, owning 1 BTC represents a significant investment in the cryptocurrency ecosystem, reflecting confidence in the stability and future growth of Bitcoin.

As the market matures and more institutional investors enter the space, the significance of holding 1 BTC could increase, potentially offering both financial gains and a sense of participation in a financial revolution. This milestone is not only about financial returns but also about being part of a movement that challenges traditional notions of currency and investment.

Rarity and Scarcity of Bitcoins

The rarity and scarcity of Bitcoin are fundamental to its value proposition. With a fixed supply cap of 21 million coins, each Bitcoin represents a finite piece of the total possible supply, making BTC inherently scarce.

This scarcity is a deliberate design choice, mimicking the properties of precious metals like gold. As more people become interested in Bitcoin, and as more coins are mined, the remaining supply dwindles, increasing the rarity of owning a full Bitcoin.

This scarcity effect is expected to intensify with each Bitcoin halving event, which reduces the rate at which new Bitcoins are created. The rarity of Bitcoin, especially in the context of owning a full coin, adds to its allure and desirability as a store of value and investment asset.

Bitcoin as a Long-Term Investment

Bitcoin’s role as a long-term investment has gained traction over the years, especially as more investors, both retail and institutional, recognize its potential as a store of value. The comparison of Bitcoin to digital gold highlights its appeal as a hedge against inflation and market volatility.

The fixed supply of Bitcoin, along with its increasing adoption, underpins its value proposition as a long-term investment. For many, holding 1 BTC is part of a broader strategy of asset diversification, reflecting confidence in Bitcoin’s future value.

As the cryptocurrency market continues to evolve, the perception of Bitcoin as a viable long-term investment is likely to strengthen, potentially attracting more conservative investors who are traditionally oriented towards long-term gains.

Psychological and Emotional Aspects of Owning One Full Bitcoin

Owning one full Bitcoin can have significant psychological and emotional implications for investors. For many, reaching this milestone is a point of pride and a symbol of commitment to the crypto movement.

It represents a belief in the future of decentralized finance and a departure from traditional financial systems. The journey to owning 1 BTC can be fraught with market volatility and uncertainty, making the achievement even more rewarding for those who have navigated these challenges.

Furthermore, as the price of Bitcoin fluctuates, the emotional rollercoaster for investors can be intense. The fear of missing out (FOMO) when prices rise and the anxiety during market downturns are common experiences among Bitcoin investors.

Nevertheless, for those committed to the long-term potential of Bitcoin, owning 1 BTC is a testament to their resilience and belief in the transformative power of cryptocurrency.

How is the Number of Bitcoin Owners Projected to Change in the Future?

As we progress through 2024, projections indicate a continuing upward trend in the number of Bitcoin owners. The surge in Bitcoin ownership observed in 2023 is likely to extend, influenced by several key factors.

Firstly, the increasing mainstream acceptance of Bitcoin as a legitimate digital asset plays a crucial role. This is further bolstered by its growing market capitalization, which adds to its allure as an investment.

Additionally, advancements in blockchain technology make the Bitcoin network more accessible and user-friendly, encouraging more people to hold Bitcoin.

The demographic spread of Bitcoin users is also expanding. Younger generations, who are more tech-savvy and open to new forms of digital investments like cryptocurrencies, including Ethereum and Bitcoin, are increasingly participating in the crypto market. This trend is expected to continue as these digital assets become more integrated into everyday financial practices.

Moreover, technological developments, especially in crypto exchange platforms, make purchasing and holding Bitcoin more straightforward than ever. Regulatory changes, though they carry the potential for both positive and negative impacts, are also guiding institutions and individual investors towards cryptocurrencies.

What are the Different Ways People Acquire One Full Bitcoin?

Acquiring one full Bitcoin, a milestone in the cryptocurrency journey, can be achieved through various means. The most common method is purchasing Bitcoin directly from cryptocurrency exchanges.

In 2024, with the bitcoin price experiencing fluctuations, savvy investors often engage in strategic buying, capitalizing on price dips to accumulate 1 BTC over time. These exchanges offer a straightforward and accessible route for anyone looking to invest in this digital asset.

Mining Bitcoins, though increasingly challenging due to the computational power required, remains a viable way to acquire Bitcoin. Individuals and mining pools invest in sophisticated hardware to solve complex mathematical problems on the blockchain, earning Bitcoin rewards in return.

Another avenue is earning Bitcoins through goods and services. Many businesses and freelancers are now accepting Bitcoin as payment, enabling them to accumulate holdings over time. Similarly, receiving Bitcoins as gifts or donations has become more common, especially in tech and crypto-centric communities.

Finally, investing in Bitcoin funds and trusts provides an indirect but increasingly popular way to gain exposure to Bitcoin. These investment vehicles are particularly appealing to those who prefer a more hands-off approach or want to diversify their investment portfolio while participating in the Bitcoin market.

Wrapping It Up: How Many People Own One Full Bitcoin?

As we journey through the dynamic landscape of Bitcoin, our exploration reveals a fascinating insight: approximately a quarter million people globally own at least one full Bitcoin. This estimate stems from the intriguing data showing 6.3 million Bitcoin addresses with balances over $1,000. By dividing this figure by the average number of wallet addresses per person (31.5), we arrive at around 200,169 individuals. Adding this to the estimated 35,256 individuals who directly hold at least 1 BTC, we reach an approximate total of 235,000 Bitcoin owners.

This number, while seemingly small in the global context, represents a significant milestone in the adoption and valuation of Bitcoin as a premier digital asset.

Our journey through Bitcoin’s ownership landscape doesn’t just end with these numbers. It’s a continual evolution, shaped by market trends, technological advancements, and regulatory shifts. As we stand at the cusp of 2024, the question beckons: will you be part of this exclusive club?

Whether you’re a seasoned investor or a curious newcomer, the time to explore and potentially invest in Bitcoin is now. Dive into the world of digital assets and be part of the financial revolution. Remember, in the realm of Bitcoin, every decision counts!